A high number of vacancies and low demand for office space in the Interstate 495 belt is making life difficult for commercial landlords, according to a report produced by a Wayland-based commercial real estate firm.

Sales of office properties in the 495 West region for the first half of 2024 totalled just $5.05 million, down 91% from the total of $56 million seen in the first half of 2023, according to R.W. Holmes’ Greater Boston Market Report for the second quarter of 2024.

“The [495 West] market continues to see tepid interest in sales, and we do not see that changing in the near future. 251 Locke Drive in Marlborough went up for auction in late June, but did not sell,” the report reads, referencing the 40-year-old, three-story office building on Marlborough’s west side that has been available since 2017. “Even with nationally known companies occupying nearly 2/3 of the building, the remaining vacancy deterred investors from stepping up to the plate.”

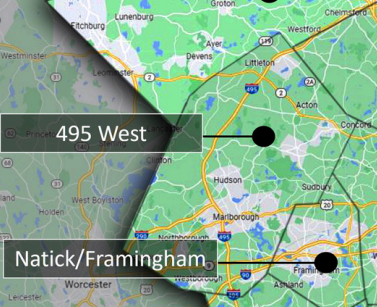

R.W. Holmes defines 495 West as communities close to Interstate 495, stretching north from the interchange with the Massachusetts Turnpike in Westborough up to Littleton, including municipalities like Marlborough, Northborough, Southborough, Hudson, Sudbury, and Acton.

Despite sales struggles, Craig Johnston, senior vice president at R.W. Holmes, doesn’t see banks taking over properties failing to attract tenants.

“We thought at one point the banks were taking back some of these assets that weren’t leasing,” he said. “In my opinion, the banks don’t want these [properties] back. They’re not geared up to take them back. They’re not key enough to run them, to manage them and then try to sell them.”

With the decline in 495 West sales aside, Johnston said there’s still a strong appetite for purchasing buildings overall, with interest rates beginning to come down and other sources of capital making up for a lack of willingness from banks to loan.

In addition to low sales, the 495 West region’s vacancy rate for office properties is 23.75%. This is lower than the rate of 30.7% seen in October 2020 during the midst of the COVID-19 pandemic, but higher than the national average office vacancy rate of 18.1% in June, according to data from real estate software firm CommercialEdge.

“We met with a group out of Hudson this morning, and they were talking about shutting down their operation, because corporate was thinking that working from home is a better model,” said Johnston. “The folks that we were working with out of Hudson didn’t feel the same, but it’s an interesting dynamic.”

The Framingham/Natick region is faring better in terms of office vacancy, with a rate of 10.25%. The area’s proximity to Boston has usually led to lower vacancy rates than places further west, said Johnston.

But commercial landlords in Natick and Framingham are facing some struggles in filling larger office spaces. The median number of months spaces larger than 10,000 square feet are sitting vacant is in excess of 16 months, according to the report.

More landlords will begin to explore carving these larger spaces into smaller leasable spaces in order to tackle this problem, Johnston said.

“If you’re sitting with a 20,000-square-foot floor plate as a landlord, I would think you’d have to be geared up to subdivide that floor down to two tenants or maybe four or five tenants,” he said.

Eric Casey is a staff writer at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.