Massachusetts ranked among the worst states in the country on property tax competitiveness, according to an assessment released Tuesday by a group that favors tax policies that it says will spur economic growth.

The new map released by the nonprofit Tax Foundation ranks states on the property tax, which is one component of the group’s 2022 State Business Tax Climate Index. The property tax component evaluates state and local taxes on real and personal property, net worth, and asset transfers.

“The states with the best scores on the property tax component are Indiana, New Mexico, Idaho, Delaware, Nevada, and Ohio,” the foundation said. “States with the worst scores on this component are Connecticut, Vermont, Illinois, New York, New Hampshire, Massachusetts, New Jersey, plus the District of Columbia.”

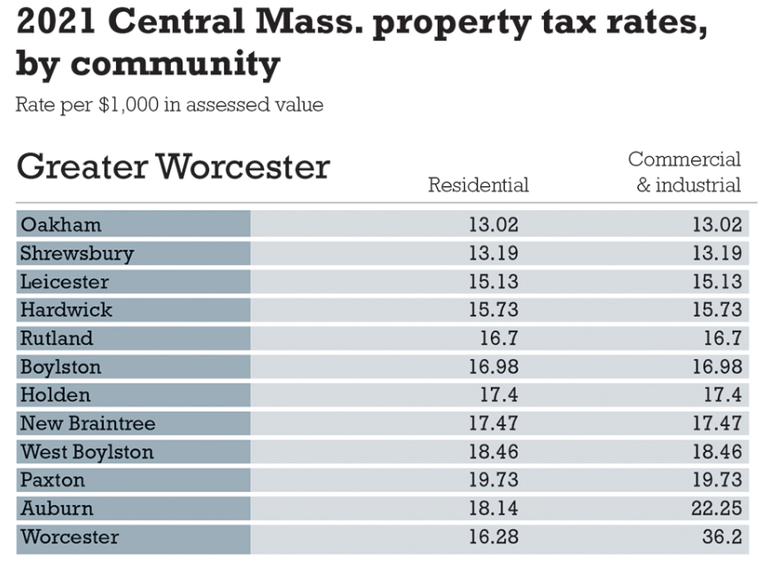

Along with income and sales taxes, property taxes account for a big share of government tax revenue in Massachusetts and growth in property taxes is limited by a ballot law approved in 1980. Property taxes are a major funding source for basic services, such as local education, public safety and public works.

The Massachusetts Fiscal Alliance, which favors reductions in tax rates, said Tuesday that relatively high property taxes in Massachusetts, combined with high inflation and a proposed surtax on household income above $1 million per year, show Democrats are on a path to drive the state economy into a “brick wall.”

While opponents of the income surtax say it will push affluent taxpayers and small businesses out of state, supporters say the measure will ensure that wealthier taxpayers contribute their “fair share” and anticipate a flood of new revenue will flow and be put toward education and transportation initiatives.