After a tedious all-day meeting that stretched the limits of commissioners’ and staff’s patience, the Gaming Commission failed to find resolution Thursday on any potential timeline for it to roll out legal sports betting. Instead, the commission recessed after 6 p.m. Thursday with a plan to try again on Friday in a meeting being called on an emergency basis.

“I am very concerned about the rate of our decision-making. I am very concerned about it,” Chairwoman Cathy Judd-Stein said as the eight-plus hour meeting neared its anticlimactic end. “I am concerned about our ability to move forward.”

The whole day was marked by disagreements, debates and a touch of dysfunction, but what really tripped the commission up was the question of when legal betting might begin and how. While there was some discussion of voting to target an in-person betting launch by the Super Bowl and a launch of mobile betting by the March Madness tournament, no such vote happened. Thursday’s meeting revealed that commissioners and staff are not all on the same page as the agency struggles to make legal sports betting a reality in Massachusetts.

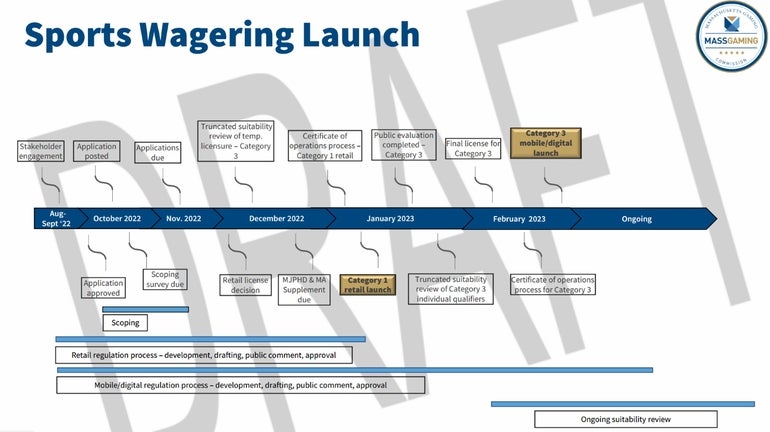

Putting extensive caveats on the first real indication of the commission’s thinking as it relates to the start of legal betting, Executive Director Karen Wells on Thursday presented the commission with what she said was the “most aggressive” timeline that she thinks is doable. Under that timeline, which represented how sports betting implementation could play out if regulators compress each step of the process to the minimum amount of time required or needed, the absolute earliest that in-person sports betting could begin in Massachusetts is early January followed by the launch of online and mobile betting around the end of February.

Wells made clear that what she put forward was not a recommendation, but an illustration of what is possible and how commission decisions about how long to give companies to complete applications, whether to put things out for public comment and more will impact the ultimate launch dates.

“This is not a definitive timeline,” Wells said. “This is a tool for discussion.”

The discussion that ensued got testy at times and shed light on stark differences among commissioners and their ideal launch dates.

Commissioner Brad Hill said he initially wanted both in-person and mobile betting to be live by the Super Bowl (Feb. 12, 2023), but now would like to see in-person betting live by the Super Bowl and mobile betting up and running by the NCAA basketball tournament in March. Commissioner Jordan Maynard said he thinks both retail and mobile betting should be live here by the Super Bowl.

Commissioner Nakisha Skinner asked repeatedly why the commission was pursuing an “aggressive” timeline and indicated that she was not comfortable with compressing the process in the interest of time.

“If this compressed timeline makes sense and it’s responsible, I’m all for it,” Skinner said. “I just need to understand the rationale for why there is being this compressed timeline advanced as opposed to a reasonable timeline by which the team can get this done.”

Commissioner Eileen O’Brien was largely aligned with Skinner and raised concerns that going with a bare minimum timeline — like giving mobile betting companies just 30 days to complete and return the commission’s extensive license application and its required attachments — will favor larger operators and work against the commission’s interest in a diverse, equitable and inclusive industry.

“They have to do more lifting than [in-person betting applicants] and we’re looking for diversity in terms of the type of companies we’re bringing in here and I worry that anything shorter than that would hamper potentially smaller companies’ ability to put in an application,” O’Brien said. “I want to get the best application possible. And to me, that would be a reasonable compromise on allowing people to be as creative as they can with what we’re asking for in community engagement and diversity and inclusion. I also feel like if you’re staggering and having retail go first, that alleviates some of the pressure going forward in the timeline.”

At least two members of the commission’s staff voiced their own concerns about the compressed timeline that Wells presented for discussion. Caitlin Monahan, the commission’s deputy general counsel, said the timeline envisions a batch of regulations coming before the commission every week but that she would be more comfortable if the legal team could brings regs forward on an every-other-week cadence.

Derek Lennon, the commission’s chief financial officer who had a role in developing the timeline, said each step of the timeline comes with a risk/benefit analysis.

“The risks of 30 days [for application completion] are the fact that you are going to limit the best application coming forward and you’re going to put a benefit towards the bigger companies,” Lennon said. “If the commission is willing to accept that risk, then 30 days is fine.”

Wells said that lengthening the process will have a greater effect on the launch date for mobile betting and that she is less concerned about the impact that changes could have on the timeline for the launch of in-person betting since it is only gambling companies already licensed by the commission that are eligible for those licenses.

The commission is under pressure to get legal sports betting up and running after the Legislature slow-walked the issue for years, but regulators have run into hurdles that have complicated their efforts in the nearly two months since Gov. Charlie Baker signed the betting law. Eager bettors are clamoring for action, and the commissioners have said they want to implement legal sports betting here without unnecessary delay but also without sacrificing their commitment to consumer protection and gaming integrity.

Before starting the timeline discussion in the afternoon, commissioners spent hours Thursday working through a 22-page draft application form and making changes in public view. Some of the work focused on big-picture issues but the meeting also delved deep into some of the minutiae of the process, like what level of detail the sports betting application should go into as it relates to the state’s public records law.

The application was presented to the Gaming Commission accompanied by a two-page scoping survey that will help commission investigators determine which companies and people they need to do background checks of, and four pages worth of regulations that spell out the application requirements.

The commission also got a look Thursday at regulations that will set the state’s tax rates for sports betting and the new tax on fantasy sports. Daily fantasy contests have been going on for years under the regulation of the attorney general’s office, but the state’s new sports betting law applied a 15 percent tax on each operator’s adjusted gross fantasy wagering receipts for the first time. That tax could be collected retroactive to Aug. 10, the date that the sports betting law took effect, the commission’s top lawyer said.

Sports betting operators will pay a tax rate of 15 percent on adjusted receipts from in-person betting (the state’s casinos, slots parlor, horse track and simulcast centers) and a rate of 20 percent on bets placed through mobile or digital platforms.

Crucially, the regulations that the commission reviewed Thursday do not speak to how the commission will handle promotional play credits.

“That is a policy question for us … that we need to probably address sooner than later and it has implications on tax,” Judd-Stein said. “We will be revisiting this regulation, probably sooner than later.”

To attract customers and keep them betting, operators offer promo play credits — “Bet $5 to get $200 in free bets!,” DraftKings advertised on its website Thursday morning — that bettors can use largely as cash. The question of whether the $200 in free bets that a customer places counts as part of an operator’s taxable revenue base has significant implications.

“To the extent that operators are permitted to offer promotional play credits, such credits should be deducted from the definition of ‘adjusted gross sports wagering receipts.’ Promotional play credits are expenses incurred by operators, not revenue received, and the relevant definition should reflect this reality,” the state’s three existing gaming operators — Plainridge Park Casino, MGM Springfield and Encore Boston Harbor — wrote to lawmakers this spring.