For 15 years, the Internet Tax Freedom Act has prohibited the federal government from forcing states to collect sales tax on items sold over the web. While that has helped e-commerce, it has hurt Main Street merchants who have advocated rather stridently that the law tilts the playing field in favor of online retailers.

Congress is now weighing the Marketplace Fairness Act, which would allow states to compel online and catalog retailers, no matter where they’re located, to collect sales tax at the time of a transaction. While the Senate passed the bill earlier this month, it’s stalled in the House of Representatives.

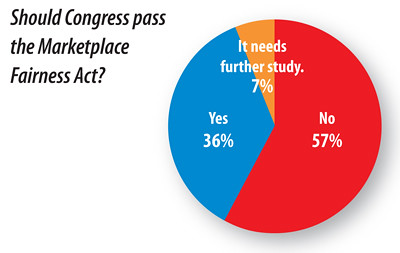

And most WBJ readers who voted in last week’s poll hope it stays stalled.

Read more