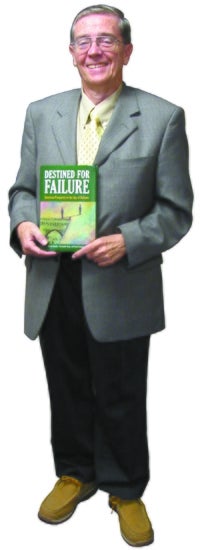

If you’re at all in doubt of economic policies coming from Washington, D.C., then you’ll likely be a fan of Nicolás Sánchez, a professor of economics at the College of Holy Cross in Worcester, who recently published a book entitled, “Destined for Failure: American Prosperity in the Age of Bailouts.” His co-authors on the book, which is available on Amazon.com, were two Holy Cross seniors: Christopher Kopp of Hamburg, N.Y., and Francis Sanzari of West Hartford, Conn. Here, Sánchez discusses why Keynesian economics should be dropped by policymakers in favor of what’s known as growth-theory economics.

>> One of the things you point out in the book is the problem with China’s currency being so under-valued. What’s the solution to that problem? Is it tariffs?

It’s not necessarily a tariff, but it has to made absolutely clear to the Chinese that this behavior is not going to be accepted. What I am talking about is saying to China that if they subsidize their production we will impose taxes on their imports. I want to make it very clear that I am very much in favor of competitive markets. But what the Chinese have been doing is not competition because they have been manipulating the foreign exchange rate.

>> What do you think of Bernanke’s comments about the economy and the measures the Federal Reserve has taken?

Everything Bernanke has been saying has been tied up to Keynesian economics. Bernanke’s solution to our economic problems is to make sure our interest rates are extremely low. But that creates disequilibrium. You may say, Well, the business community likes low interest rates, and I will say, Yes because they are thinking of themselves as individuals. They are not thinking of themselves as a community. The Wall Street Journal reported that very low interest rates have allowed companies that would otherwise have gone under because they are not competitive to remain in the market. Interest rates are too low, which allows certain companies that would have gone under to survive.

>> Aren’t current policies about protecting jobs? And without them, wouldn’t there have been very severe pain for America, at least in the short-term?

Our American economy doesn’t work because firms survive. Our American economy works because there are new companies that come in, with technological advancements and then the technological advancements create the new jobs. We’re running the economy based upon politics, but we’re not running the economy based upon how the economy actually works.

>> As an advocate of growth theory and a critic of Keynesian economics, you’re in the minority in your field.

No, I would disagree with you. Keynesian economics is easy to understand. The field of growth theory has expanded dramatically over the past four years. But it is highly mathematical. It hasn’t gotten out there to the population as a whole. You could say I am in the minority in terms of the public discourse. But growth theory is a major part of macroeconomics today.

>> Is the book a response to that?

When I saw what was happening in the economy, I said this is going to drive us into disaster. And then I began saying to myself, Why don’t people understand this? I realized that people don’t understand it because people are still tied up to Keynesian economics. It became clear to me that I have to try to convey to people that our growth depends upon productivity improvements.

>> If you had two minutes with the president, what would you say?

I would say fire all the advisors who did not see what was coming. And the reason for that is because their models are based upon Keynesian models.

Online Exclusive

>> What do you see as the structural problems in America’s economy?

Most people think that our problems are based upon the government and their spending more or the government taxing less. That approach is based on Keynesian economics. There is an alternative approach called growth theory. In growth theory we look at how well the markets are functioning. You look at the amount of savings that is being generated and you look at the amount of technological change that is taking place. Our markets are not working efficiently.

>> I’m struck by how much our economy has moved from a manufacturing base to a consumer base. How much does that shift play into your theories?

It does play a role because the foreign exchange rate has really distorted our production I think we would have retained a much greater industrial base if the foreign exchange rate had not been distorted. There are a lot of American companies, that if the for exchange rate had not been what it was, would have stayed in American.