Downtown Fitchburg has struggled to attract new growth when so many people are following jobs to more prosperous areas or finding affordable areas elsewhere.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Downtown Fitchburg has struggled to attract new growth when so many people are following jobs to more prosperous areas or finding affordable areas elsewhere.

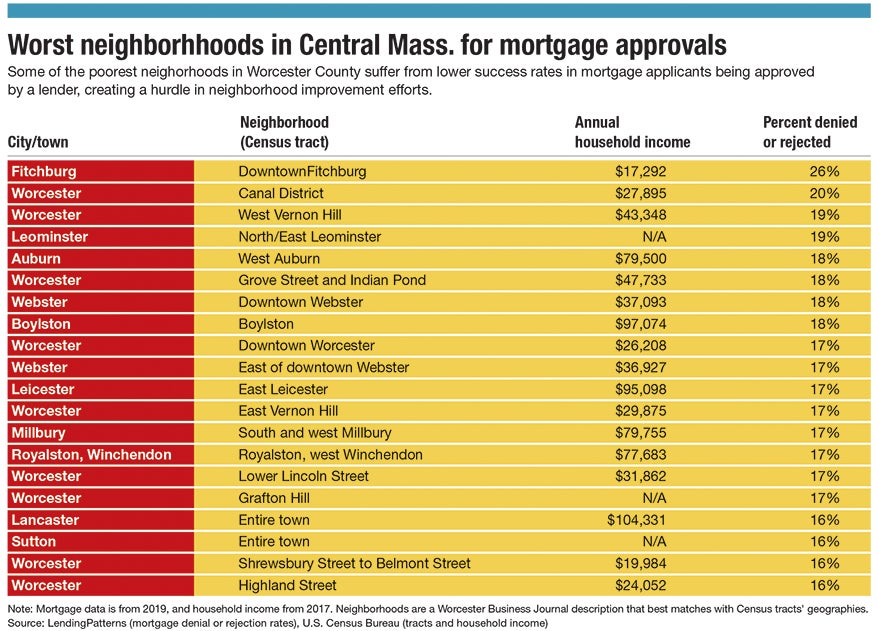

It only compounds the problem when residents looking to buy a home downtown are the least likely to be able to be approved for a mortgage of any neighborhood in Worcester County. That finding, part of a joint five-month investigation by the Worcester Business Journal and Worcester Regional Research Bureau into racial discrimination in mortgage lending in Central Massachusetts, highlights how persistent problems can be in improving some of the region’s most racially diverse and worst-off neighborhoods economically.

“Getting more homeowners into a neighborhood that might have some challenges can be stabilizing. People feel invested in the neighborhood, not just their home,” said Liz Murphy, Fitchburg’s director of housing and development.

“Homeowners can see the whole neighborhood as part of their home,” Murphy said. “They’re buying more than just a house.”

Downtown Fitchburg, the poorest Census tract in Worcester County, isn’t alone in having difficulty not only attracting residents but in particular those looking to buy there, to literally be invested in the neighborhood. In Worcester, three of the poorest neighborhoods – downtown, the Canal District and Vernon Hill – also struggled with some of the worst mortgage approval rates in Central Mass.

Though the sample size was small, measuring just 2019, the only recently available year, the data illustrates the difficult task in front of city and state officials and their community partners. Many of the same people who are looking to buy in such neighborhoods may have the least amount of money to put into a down payment, or a troubled credit history making them less attractive to lenders.

What each of those neighborhoods have in common, aside from economic troubles, are their difficulty in getting people who want to buy a home in those neighborhoods approved for a mortgage. At least 17% of prospective homeowners were unable to get a mortgage in 2019, and in downtown Fitchburg that rate was 26%.

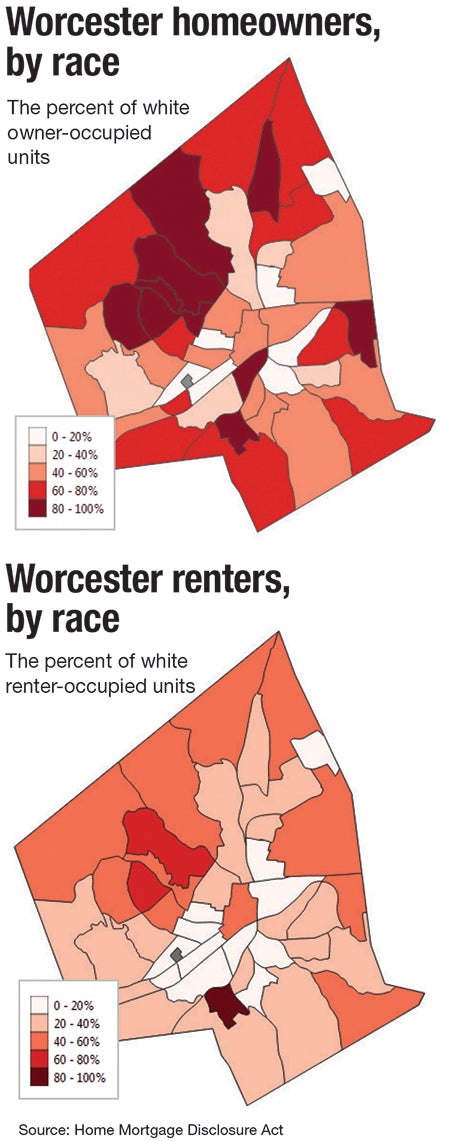

These poorer neighborhoods are some of the most racially diverse in Central Mass. In Worcester, for example, the top 10 U.S. Census tracts by income have 90% white homeowner populations, while the bottom 10 are 65% white.

City of Fitchburg officials and their partners see a need for more homeowners and are working to use government tools to help the process.

“People need to be invested in the neighborhood,” said Marc Dohan, the executive director of NewVue Communities, a Fitchburg nonprofit aiding prospective homebuyers.

“That’s key. A renter can be invested. A homeowner can be invested,” Dohan said. “You need a good mix.”

Partnerships and public aid

Cities have help available from state and federal agencies to aid residents looking to buy homes.

The state agency MassHousing helps with down payment assistance, much of it for lower-income households and to Gateway Cities, diverse and economically challenged communities, such as Fitchburg and Worcester.

In the past five years, MassHousing says it has financed $3.4 billion in mortgage activity statewide, with 43% of that taking place in Gateway Cities. Worcester, easily the biggest Gateway City by population, has received the most funding at nearly $166 million. Another nearly $46 million went to Fitchburg.

“The effects of homeownership on a neighborhood are tremendous because you’re building roots,” said Mounzer Aylouche, the vice president of homeownership programs for MassHousing. “You become a major contributor to the micro-economy of that community.”

In Fitchburg, city officials are working with NewVue and the Mass. Department of Housing and Community Development in a pilot program called Liabilities to Assets to redevelop blighted homes vacant for at least three years. The homes are sold at affordable prices to those who agree to live there for at least seven years.

Other efforts have included creating a downtown district under the state’s Housing Development Incentive Program to incentivize market-rate housing. The first such housing under that initiative, a seven-unit project a block north of Main Street, is set for completion in June.

In Worcester, the city administration launched in 2019 an initiative called Worcester Housing Now aimed at helping homeowners and builders preserve old housing, which requires more regular upkeep. Triple-deckers, which line so many neighborhoods, were highlighted as key to maintaining housing supply.

Worcester is looking to help bring longer-term sustainability to city neighborhoods, said Jim Brooks, Worcester’s housing development director. One resource is rehabilitation funding for owner-occupied homes with two to four units. Much of Worcester’s multifamily housing is no longer owned by someone who lives on-site, Brooks said.

“Owner-occupied homes can have a lot more buy-in and a lot more pride than renters, who can be more transient,” Brooks said.

Old housing stock can be an impediment to would-be homebuyers getting approval for aid, Murphy said.

The Federal Housing Administration’s homebuying loan has a housing code-compliance clause, meaning a household might not get approved for a mortgage at a home needing some work.

“That can be a huge barrier,” Murphy said. “Someone can’t buy a fixer-upper, which might be the only thing they can afford, because it won’t pass FHA inspection.”

A downward homeowning trend

Local cities’ challenges in helping more people buy homes comes as homeownership rates have been on a slight but steady decline nationally.

In 2005, before the last housing peak, roughly 69% of households nationally owned their home, according to the Census. That rate bottomed out at about 63% in 2016 before rebounding a bit since.

Still, all of the recent uptick has taken place among high-earning households, according to a 2020 report by the Harvard Joint Center for Housing Studies in Cambridge. More higher-earning households bought homes but lower-earning counterparts were less likely to buy.

A 2018 report by the Urban Institute, a Washington, D.C., economic and social policy think tank, highlighted what it called an alarming drop in homeownership rates among those with no more than a high school education.

Prices have only increased at sharper rates since the coronavirus pandemic hit.

“Overnight, you saw property values skyrocket,” Aylouche said. “It’s not good for the customer that MassHousing is looking to help.”

That downward trend was decades in the making, and demographics show homeownership rates may lag for years to come, according to the Urban Institute. Each subsequent generation – from Baby Boomers to Generation X, and from older Millennials to younger ones – has a homeownership rate lower than that of the generation before them at the same age.

The reason fewer are buying homes is simple, according to the Harvard housing center: median sale prices of single-family homes rise faster than median household incomes. In 2019, the latest year available, that circumstance took place for the eighth straight year. It was the fourth straight year the median sales price quadrupled the median household income, a tipping point at which homes generally become unaffordable.

A 2019 survey by federally sponsored lender Freddie Mac confirmed the worries about home affordability. Half of renters called a lack of money for a down payment and closing costs to be a major obstacle to home buying. About half also said they made spending or housing changes to afford monthly housing payments, including 62% of renters and 47% of homeowners. The burden of costly student loans and child care costs were cited by Millennials, who now make up the country’s biggest generation and an age group now in prime homebuying years.

That movement could worsen inequality. That’s because homebuying is considered a key way to build household wealth. A 2018 report by the Urban Institute found owning a home generally gives a better return on investment than stocks or bonds. That was the case even when homes were sold at a low point in the market.

“The fact that homeownership is prevalent in almost all countries, not just in the United States, and especially prevalent for people near retirement age,” the Urban Institute said, “suggests that most households still view homeownership as a critical part of a life-cycle plan for savings and retirement.”

Massachusetts home prices rose 14% in the past year through March to hit a median of $460,000, according to Peabody real estate data firm The Warren Group.

With demand for housing outstrippling supply, homebuying is becoming increasingly unaffordable in Central Massachusetts, particularly for first-timers, Dohan said.

“Right now,” Dohan said, “the number one, the number two and the number three issues are inventory.”