Cautious optimism. These two words are perhaps the most succinct way to summarize how some of the region’s economists and business figures feel about the state of the Central Massachusetts economy.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Cautious optimism.

These two words are perhaps the most succinct way to summarize how some of the region’s economists and business figures feel about the state of the Central Massachusetts economy.

While much was discussed of an expected recession in 2024, those fears have proven to be unfounded. Despite the region’s persistent housing crunch, typical indicators used to measure the health of the local economy remain steady.

“If you'd asked me a year ago in 2023, I would have thought we were heading into a recession,” said Roy Nascimento, president and CEO of the North Central Massachusetts Chamber of Commerce. “The economy just continues to surprise me, and the local economy just seems incredibly resilient.”

The local economy is proving to be strong, although Central Mass. doesn’t exist in a vacuum, said Luis Rosero, professor of economics at Framingham State University and co-director of the MetroWest Economic Research Center.

“We have some pretty strong fundamentals,” he said. “But we're also not immune to the headwinds of the national and global economy.”

High employment and somewhat high confidence

The Worcester region’s non-seasonally adjusted unemployment rate for April sat at 3.2%, a tenth of a percentage point higher than the statewide rate of 3.1%. The Framingham area’s rate came in under the statewide rate, at 2.6%, while the Leominster-Garder region was at 3.6%.

With the exception of Leominster-Gardner, these rates come in under the national April unemployment rate of 3.5%. All of these rates, including national unemployment, sit lower than where they were to begin 2024.

Business confidence in Massachusetts is largely holding steady, said Olena Staveley-O'Carroll, associate professor of economics at the College of the Holy Cross in Worcester and a member of the Associated Industries of Massachusetts Board of Economic Advisors.

“Businesses in Massachusetts, on average, seem to be confident about the future,” said Staveley-O'Carroll. “On a more localized level, Worcester and more eastwards businesses are more optimistic about their conditions than Western Massachusetts, where confidence levels are a bit lower.”

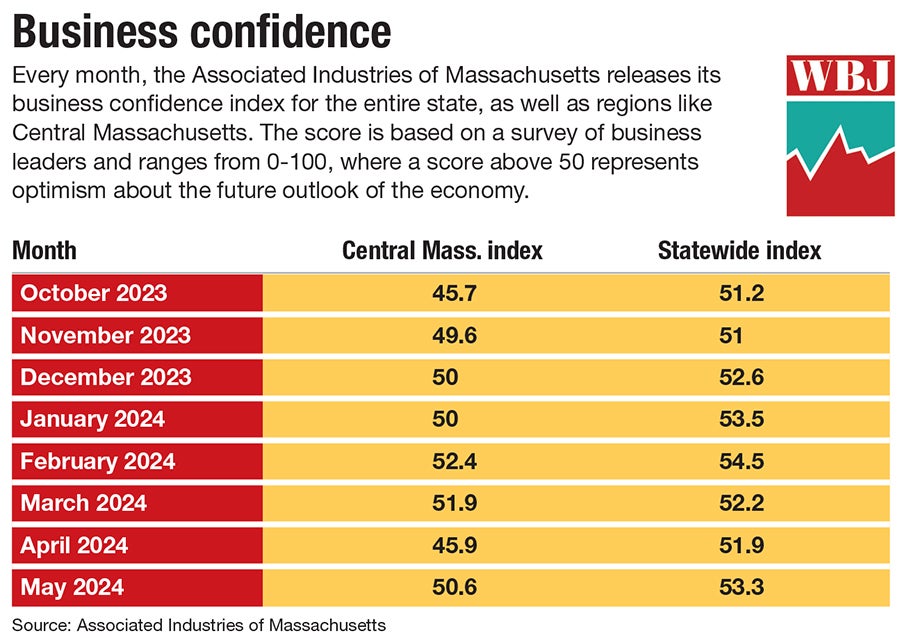

In May, the Associated Industries of Massachusetts’ statewide business confidence sat at 53.3, slightly lower than the beginning of the year, where it sat at 53.5. After a short dip which saw it reach a near all-time low in April, AIM’s Central Massachusetts index sat at 50.6 in May, higher than January, where it was at 50.

Scored on a 100-point scale, an index number above 50 represents an optimistic outlook, while a number below 50 represents a pessimistic outlook.

A similar trend is playing out with other economic stats, Staveley-O'Carroll said.

“I looked at some data on inflation and unemployment and Boston, Worcester, and the Framingham area are doing quite well, and maybe even above national average in terms of performance,” she said.

One area of the economy where business leaders are less optimistic is the manufacturing sector; AIM survey data from May showed manufacturers scored at 46, while non-manufacturing enterprises scored at 54.7.

Despite less-than-optimistic sentiment from statewide manufacturers, North Central manufacturing firms are starting to see the light.

“Manufacturing had a little bit of a downturn, but has climbed out of that,” said Nascimento. “There's a lot of demand for their products. They're hiring. They're continuing to expand.”

Problems with housing

Despite the upturn, one issue continues to impact Massachusetts employers and employees, both inside and outside of the manufacturing space: the region’s persistent housing crisis.

Worcester and Middlesex counties saw 3,415 single-family home sales from January to April, a slight 1.6% increase from the 3,361 seen during the same period last year, according to data from The Warren Group, a Peabody-based real estate research firm.

However, prices for single-family homes consistently creep upward; the average median sales price for single-family homes from January through April was $440,000 for Worcester County and $810,000 for Middlesex County, increases of 7.3% and 11% compared to the same time period from last year.

Renters aren’t finding much relief either; an April study by Forbes Advisor, a financial news and information service in New Jersey, found Greater Worcester was the third-most competitive rental market it studied. Worcester had the second-lowest vacancy rate of examined areas, at 1.7%, with a median price of $1,995 per rental, almost $200 higher than the study's median price of $1,804.

“When you ask employers what is the biggest challenge in the MetroWest region, the number one is housing costs,” said Rosero, citing figures from a MERC study showing labor costs, which is an issue connected to rising housing costs, coming in second. “[Businesses] are having a hard time finding workers.”

The labor issue is a complicated one, but the cost and lack of availability of housing plays a role, Nascimento said.

“I do think the housing issue just makes the labor issue worse, because our cost of living here is so much higher than other states,” he said. “There's not a lot of inventory out there. That’s certainly part of the high cost of living that we have here in Massachusetts. The number one challenge we probably hear from employers is around finding qualified skilled workers. And that's moderated a little bit, but it's still a big concern.”

The vibecession

Despite the fact many traditional indicators of the economy are looking positive, there’s still talk of a vibecession, where consumers feel the economy is floundering, despite stats saying otherwise.

“Not all consumers understand the difference between inflation and price level. So to their mind, when economists say, ‘Oh, inflation is coming down,’ they kind of expect the prices of milk or gas will go back to pre-pandemic levels,” said Staveley-O'Carroll. “This is definitely not the case, almost never do we experience deflation.”

Even if the lack of consumer confidence in the economy isn’t entirely based on statistics, that still could have an impact on the region’s economy, said Nascimento.

“It's on the consumer side, those are the ones that are feeling that state of inflation, with groceries, housing, and energy costs being up,” he said. “Consumers are a big part of the economy as well. So if they start to cut back that could hurt our economy here in North Central and the rest of the state.”

Prices for basic necessities in the Central Massachusetts region are seemingly beginning to stabilize, said Rosero.

“Inflation is no longer [problem] number one, but it still hasn't gone away,” he said. “We send our interns every April on a tour, to local stores, doctors offices, etc., to price out different things. We are starting to see a bit of a cooldown in prices. It’s probably too early to tell, and it’s only one data point; but it does seem to be in line with [other statistics].”

The bottom line

While some consumers may remain skeptical about the health of the economy, MetroWest businesses are beginning to be more optimistic; MERC survey data shows 59% of businesses feel the economy is the same as last year, while 27% feel it is better.

“There's a high degree of this significant disconnect between how we're doing and how people think we're doing in terms of the economy,” said Rosero. “But it was a little bit refreshing to see that employers at least, you know, they're not negative about it. They're seeing that bottom line.”

Despite mixed economic signals, Staveley-O'Carroll sees a lot of things to be positive about.

“The economy has proven dramatically resilient,” she said. “Unemployment rate has remained near-historic lows, GDP growth continuously surprises forecasters and analysts. It slowed down a bit this year, but you know, it's still positive for us.”