Most people are familiar with how a home pregnancy test works, but the same technology behind those devices is used in different ways and in different industries outside of life sciences, such as food and beverage, veterinary services, water quality and environmental safety.

VICAM, a business unit of Milford-based Waters Corp. that provides mycotoxin test solutions and food safety technology, uses lateral flow immunoassay testing (LFI), the same technology behind home pregnancy testing products, to test products. LFI tests account for about 20 percent of VICAM’s business, but Managing Director Marjorie Radlo-Zandi said that is going to grow.

“Right now lateral flow devices are about 20, 25 percent of our business. Over the next few years they’re going to be over 50 percent of our business, and it could be over the next 10 years it will be about 80 percent of our business,” Radlo-Zandi said.

Radlo-Zandi spoke at the launch of a new production center that brings LFI tests along the supply chain from scientific development to commercialization under one roof. It’s a new facility that is an expansion of manufacturer Web Industries’ Web Boston facility, located in Holliston.

Since their first commercial launch on the market in the late 1980s, LFI devices have been used in clinical, veterinary, agricultural, food, bio-defense and environmental settings, according to the website of Cytodiagnostics, a Canadian biotechnology company that manufactures parts for the tests. Web Industries built the facility because it wanted to bridge the gap between the science and commercialization aspects of LFI test production, said Blake Batley, the company’s chief sales officer.

“These are devices that need to be rapid in terms of their results. They need to be incredibly accurate and precise,” Batley said. “They need to be able to provide very complex results, but in a form that take on an easy-use form – one that can be used at point of care or point of application. They need to be lower cost, they need to be readily available around the world for a number of applications.”

Why LFI?

According to a report by research provider MarketsandMarkets, the lateral flow assay market has an anticipated compound annual growth rate of 8.3 percent between 2015 and 2020, when the market is expected to be valued at $6.78 billion. The market’s growth will be driven by increased usage of the tests in home settings, their increasing applications in clinical diagnostics, a rising elderly population, a high prevalence of infectious diseases and other factors.

North America had the market’s largest share in 2014, followed by Europe, but LFI devices’ most rapid growth will take place in the Asia-Pacific region because of its less stringent regulations and healthcare factors like rising awareness, improving infrastructure and increasing demand for better value.

Demand for LFI devices is growing because they’re easy to use and provide quick diagnoses without having to be sent away to a lab for results, said Angus McQuilken, vice president for communications and marketing at the Massachusetts Life Sciences Center (MLSC).

The tests can work well in early-stage detections for several infectious diseases, like the Zika and Ebola viruses, McQuilken said. Several Massachusetts companies, including Boston diabetes care startup Jana Care, use LFI technology in their blood-glucose monitoring tests.

“It has enormous potential benefits in regions of the world where diagnosing early can cause public health officials to prevent a spread,” McQuilken said.

Corporate partners

A global presence on the lateral flow market is Germany-based Siemens Healthcare, a longtime partner of Web Industries in various segments of the medical market.

Peter Janeczek, director strategic procurement, point of care, at Siemens Healthcare, said LFI tests are some of the fastest-growing products at Siemens.

“It offers quick, reliable [results] with very little patient sample, and no sample preparation,” Janeczek said. “Many of these factors are differentiators from other diagnostic tests in the marketplace and allow our healthcare customers to focus less on testing and focus more on patient care.”

Newest player

About four years ago, Web Industries launched a task force to figure out how it could expand its operations and lead the charge on a technology that is in high demand. They found that opportunity in LFI device manufacturing and production, Batley said.

“These are the types of tests, these are the types of platforms that are going to provide the ease of diagnostics that might have taken hours, days, weeks for analysis that can now be done at the point of application,” he said.

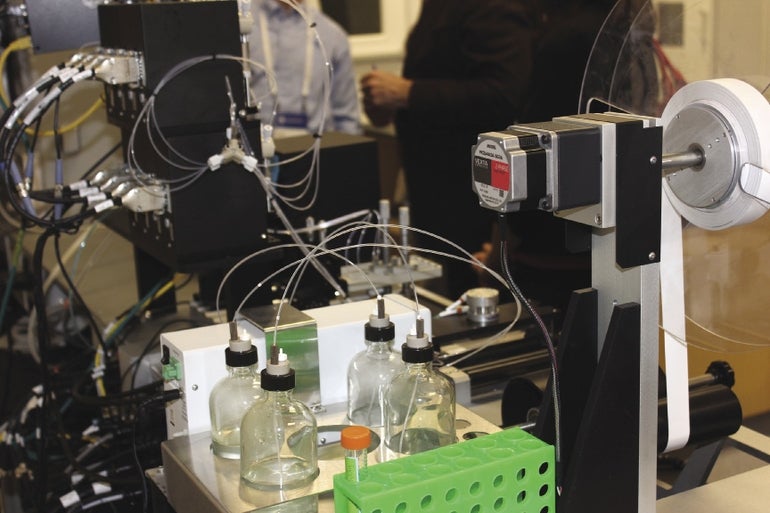

The new 6,500-square-foot manufacturing facility has commercial-scale biochemistry laboratory capabilities, automated reel-to-reel device production, device assembly, packaging and private labelling. Web Industries is the only non-competing medical contract manufacturer in the U.S. to offer reel-to-reel strip manufacturing, device assembly and packaging services at commercial-level volumes, according to the company.

The company received $150,000 in MLSC tax incentives for its commitment to hiring 10 new employees this year. It could add up to 40 employees as a result of the new center. The facility has the potential to double in space, said Laurie Partridge, a company spokesperson.

Location was a key factor when MLSC was deciding which companies should receive tax incentives, McQuilken said. MLSC made sure several of the receiving companies were located outside of Boston and Cambridge.

The MetroWest region is a hotbed of life sciences growth, he said. Over the past three years, the city of Marlborough alone added 6,000 jobs, two-thirds of which were in life sciences.

“The benefit of Web Industries increasing its capacity in manufacturing in space is that companies developing those technologies will be able to manufacture them here in Massachusetts,” McQuilken said.