Old Sturbridge Village, a living history museum depicting antiquated aspects of daily life in the 19th century, educated more than 239,000 visitors last year. Now, thanks to a recent amendment to what some argue were antiquated nonprofit endowment spending laws, OSV can plan for the future.

“It’s been a real rollercoaster,” Ann Lindblad, marketing and communications director at OSV, said of the stock market fluctuations that have impacted many nonprofit organizations, including Old Sturbridge Village. “Being able to access our endowment allows us to keep our high level of visitor experience going.” OSV was founded in 1946 and employs 182 people.

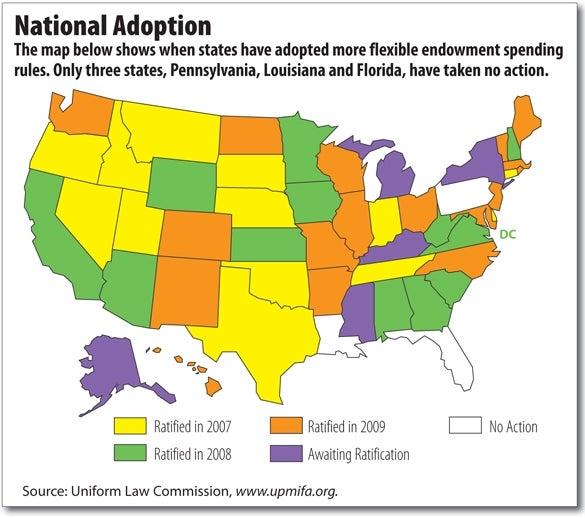

New Laws Of The Land

Old Sturbridge Village and all other nonprofit organizations have greater access to their endowment funds thanks to the Uniform Prudent Management of Institutional Funds Act (UPMIFA), which was ratified by Gov. Deval Patrick July 2. Previously, nonprofits could only spend a portion of an endowment’s appreciated value. In other words, if an organization had a $1 million endowment, that organization could freely spend any of the income generated by its investment, so long as the original amount of the gift—$1 million—remained intact.

However, due to the severe stock market declines last year, a $1 million investment could now be worth much less. Under the previous endowment law, if it were valued at less than $1 million, an organization would be unable to access any of that money.

Ellen Dunlap, president of the American Antiquarian Society, a Worcester-based nonprofit, says the new policy compliments the way many nonprofits are now investing.

The previous law “basically said that preservation of the original capital was the only important thing,” she said. “But the timing of the market is such that you could be very prudent of your management, but if an endowment happened to be created on the downturn of a cycle, you were screwed.”

According to Dunlap, nonprofits began shifting their investment strategies to be more profitable over the long-term, but endowment spending policies failed to account for that. As a result, spending limitations for nonprofits were at the whim of the stock market every year. Now, UPMIFA allows nonprofits to act “prudently” when dipping into their endowment funds, but it does not give them unrestricted, free reign. The act defines “prudent” as a portion of the fair market value of an endowment between 4 and 7 percent. And, when generating the fair market value, nonprofits must calculate it based on an average of quarterly results over at least a three-year period. And that three-year period must immediately precede the year in which the endowment funds will be spent.

For the nonprofits that find most of their endowments under water — that is, at a current value below the original amount of the gift — the access to additional capital will allow them to maintain services and avoid cutting jobs. But even for organizations that don’t have to worry about those types of situations, the new policy offers other benefits.

Take the College of the Holy Cross, which reported that about 50 percent (or $250 million) of its total endowment was restricted. Of that $250 million, $60 million was underwater — a result of younger funds that had less time to appreciate in value before the stock market spiraled downward last year.

Michael Perry, the vice president of development and alumni relations at the college, says given the school’s spending rule of 4.5 percent, $2.7 million would be inaccessible. However, he says capital from the remaining $190 million covered any of the hardships that would have existed had the amount underwater been higher.

He also said the school is “prepared to move unrestricted funds over to cover the lost income in the areas of financial aid and faculty salaries.”

In regards to the new policy, he said it opens up new avenues of communication with those bestowing gifts to the college.

“It allows us to proactively have good conversations with donors about what the options are going forward,” he said.

UPMIFA will also positively affect the grant-making nonprofits, such as the Greater Worcester Community Foundation, which, according to Executive Director Ann Lisi, receives two-thirds of its gifts in restricted form.

She said the Greater Worcester Community Foundation’s endowment fell from $135 million to $88 million over the course of last year. Under the previous spending laws, the foundation’s 2009 grants budget (based on the board’s selected 4 percent spending rate) would have been $400,000 less because of underwater funds. But now, because of UPMIFA, the foundation can meet its projected $3.5 million grants budget.

Looking beyond the nonprofits and grant-making institutions, Lisi says the new law is likely to please donors, as well.

“When people have an intent to help, they don’t like to see a year when spending is not allowed,” she said. “The purpose of the charitable fund is to do good things today.”