Large for-profit life sciences companies have called Central Mass. their home for decades. Now, they play an important role in bringing talent, investment, and research to the region.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Since 2004, Google searches for “life sciences” from people in Massachusetts have been nearly twice as frequent as in any other state in the country, according to Google Trends. The innovation hub in Boston and Cambridge certainly accounts for more than its fair share of interest in life science in the state and across the country, but increasingly, growing biotech, bioengineering, and pharmaceutical companies based outside of the I-495 corridor are changing the landscape in the state by attracting talent and putting Greater Worcester on the map.

Central Massachusetts is home to a half dozen life sciences firms with more than 1,000 employees in the region, and another dozen global biomedical companies tout significant Central Mass. facilities of at least 200 employees, according to 2021 data compiled by the WBJ Research Department.

Local employees at Waters Corp. in Milford total 1,600, Insulet in Acton employs 1,145 in the region, and Bristol Myers Squibb in Devens reported 1,100 workers in Central Mass. Their global revenues, too, were among the highest of all public companies in Central Massachusetts, with Bristol Myers Squibb reporting $46.4 billion, Waters reporting $2.7 billion, and Insulet reporting $904.4 million.

These large companies anchor the growing life sciences economy in Central Massachusetts. Coupled with research and development at the region’s colleges, universities, and incubators, having for-profit companies with significant financial resources attracts investment and facilities to the region, while creating a hub for talented workers, which is a growing concern among life sciences organizations of all sizes.

A selling point

This landscape is helping business boom at Mustang Bio, a clinical-stage biopharmaceutical company, said Debra Manning, its senior vice president of human resources. Headquartered in Worcester, Mustang Bio was founded in 2015 and has since seen growth year after year, now with 29,000 square feet of both research and manufacturing space. The influx of new biotechnology and life sciences companies coming to Worcester and the region’s welcoming of Mustang Bio is a draw and remains a selling point for bringing in new employees.

“We know that this area is hoping to add more biotech, and we love that. Candidates cite our location as a plus,” Manning said.

At the end of 2019, Mustang Bio had 39 employees. As of March 2023, that number is 110 and still growing, said Manning. With the growth in employee count, the footprint of Mustang Bio’s operations is growing, too. The company’s Plantation Street address is among the UMass Chan Medical School-adjacent hub, which includes Charles River Laboratories and AbbVie. The significantly lower cost for space in Worcester as compared to Boston and Cambridge has allowed Mustang Bio to build out its operations in cell and gene therapy right on site, with a new wing bringing the company to four clean rooms in its labs.

That type of space is advantageous even to large corporations like AbbVie, a pharmaceutical company headquartered in Chicago with significant operations in Worcester. Known for its flagship product Humira, the drug alone earned Abbvie $21.2 billion in 2022.

AbbVie’s operations in Worcester center the discovery phase in the process of developing biotherapeutics and include manufacturing under the same roof. The ability to finance that is to the advantage of the corporation and to the scientists at all stages of research, said William Blaine Stine, senior director of biotherapeutics and discovery research at AbbVie. The large size of AbbVie means more resources, and for researchers, a greater ability to focus on that work.

“We get to spend every hour of every day thinking about the science,” Stine said.

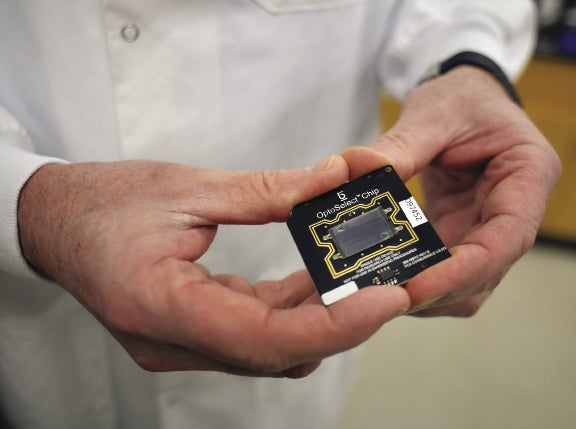

At AbbVie, one thread across research projects involves seeking out B-cells secreting specific antibodies. New technologies and machines are allowing AbbVie’s scientists to work at rates that were unimaginable even a few years ago. In a matter of years, said Stine, scientists have gone from manually using pipettes to having the technology to test in 14,000 nanopen chambers simultaneously. Being at a large company like AbbVie means cost is less of a limiting factor for researchers, said Stine.

This technology is being applied across research areas, and has shortened the timeline of a test from months to 24 hours, allowing for nearly infinitely more testing, a necessity in scientific research where there is a long road between discovery and development.

“A lot that we are working on might not make it there, but we are the perpetual optimists,” said Stine.

In the same neighborhood as Mustang Bio, Abbvie regularly collaborates with UMass Chan’s scientists, overlapping the corporate and academic spheres to its advantage. That, coupled with the ability for grant and startup funding to go much further than in Boston, makes for a winning combination.

“Worcester is so well situated right now,” said Stine.

The advantages of AbbVie’s Worcester location are growing and with that a wider talent pool is enticed, he said. Still, looking among the local talent pool and helping workers rise in the ranks is a goal.

“We source talent globally, but we want to develop talent locally,” Stine said.

Recruiting and retaining

Talent development is top-of-mind across the life sciences industry. At Waters Corp., a laboratory equipment manufacturer founded in Framingham in 1958, creating a pipeline for young, junior talent is the top priority, said Katie O’Neill, its vice president of human resources.

Internship programs and college recruitment work helps the efforts, but filling early-career positions remains an area needing attention, said O’Neill.

“Life sciences will always continue to grow,” O’Neill said at the WBJ Life Sciences Forum at the DCU Center on March 7. She cited a 4% increase in employee count at Waters, despite what she described a hiccup in hiring, creating challenges.

Even while competition is stiff for junior talent, the market is still welcoming to up-and-coming companies, able to position their newer approaches to life science research to draw in young employees. At Mercy BioAnalytics, Inc., there is recognition of both this labor market and the abundance of life sciences companies vying for funding from the same sources to solve similar health problems.

“It’s a very crowded space, but we are taking a fundamentally different step,” said Dawn Mattoon, CEO of Mercy BioAnalytics.

Started in Cambridge and now based in Natick, Mercy BioAnalytics research is focused on the early detection of cancer using liquid biopsies. The technology utilizes biomarker co-localization of blood, which carries detectable markers of cancer. Mercy’s technology is designed to detect early stage cancer, when it is most curable.

“It’s an enormous unmet need,” said Mattoon.

The Natick location has allowed Mercy to nurture itself out of the startup phase, said Mattoon.

There’s volatility in the market, but with it comes newly available talent, too.

At Mustang Bio, new space brings the need for new faces in the facility. And bringing those new workers into the Central Massachusetts economy has been easy, said Manning. It’s one of a number of reasons the company has no plans to leave the region.

“We have no trouble hiring people here. It’s just the opposite,” said Manning. “We plan to stay.”