Overall, more than 20,000 PPP loans for a total of $1.8 billion were given out to businesses across Worcester County, with more than 4,800 and $450 million of those loans going to businesses within the city of Worcester, according to data from the SBA.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

More than two years ago, small businesses across Greater Worcester and the nation faced a devastating and unexpected blow to their operations.

The COVID-19 pandemic caused thousands of businesses across Worcester County to temporarily shutter, many ending up having to close their doors for good. Businesses deemed non-essential, such as restaurants and hotels, felt the brunt of the economic restrictions the federal and state governments imposed to minimize spread of the virus.

One of the main responses from the federal government and the U.S. Small Business Administration was the Paycheck Protection Program. The loans were first distributed in 2020 around the beginning of the pandemic, with an additional round in 2021. Initially, 75% of loans were to go toward paying employee wages, but this was eventually lowered to 60% to allow businesses to pay additional overhead costs.

Overall, more than 20,000 PPP loans for a total of $1.8 billion were given out to businesses across Worcester County, with more than 4,800 and $450 million of those loans going to businesses within the city of Worcester, according to data from the SBA. Those loans went toward paying the wages of more than 150,000 jobs in the county, including more than 35,000 jobs within the city of Worcester.

“It shows how important it was for our economy to be able to rebound,” said Alex Guardiola, vice president for government affairs and public policy at the Worcester Regional Chamber of Commerce. “I don’t think that the majority of these companies that are open now would be open without them.”

Dispersing the funds

Local banks in Central Massachusetts played a crucial role in ensuring businesses in the area were able to secure the loans they needed, Guardiola said.

“Now, you can imagine that every business across the spectrum, regardless of industry, was trying to apply for those PPP loans. So we worked very hard with our small community banks here in Worcester to help navigate through these loans,” he said.

Banks headquartered in Worcester County and MetroWest wrote the majority of loans for small businesses in the area, according to the SBA data. In Worcester County, local bank lending was led by UniBank in Whitinsville, with $107 million in SBA loans, followed by Cornerstone Bank in Worcester with $99 million and Webster Five in Auburn with $82 million.

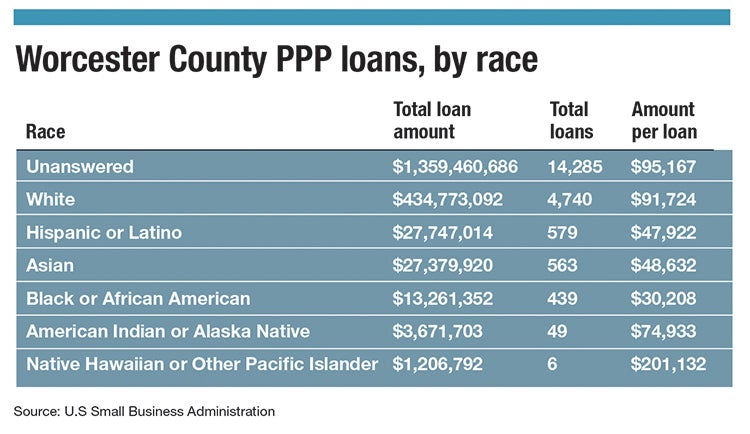

Businesses identified as female- or minority-owned businesses received lower amounts on average than businesses that either did not identify themselves or identified as being owned by white men, according to the SBA data.

“It was working-class communities that were hardest hit, while also receiving some of the least in terms of financial assistance,” said Kareem Kibodya, co-policy lead at the Black Economic Council of Massachusetts.

Businesses that identified as female-owned in Worcester received on average around $55,000, around half that of businesses that identified as being male-run, according to SBA data. Black-owned businesses got on average about $32,000, a third of what businesses identified as white-owned did.

Local banks didn’t have the same kind of close-knit relationships with local communities of color as they did with white-owned businesses, causing minority-business owners to be more reserved when asking for loans, Kibodya said.

“Whether its historical disparities due to redlining or current issues of access to capital, if you don’t feel if you have that relationship with your local bank, or every time you go there you feel that you’re not necessarily welcomed with open arms, you’re going to be a little hesitant to go there in the future,” he said.

The immigrant experience

Jose Zuniga, who immigrated to the U.S. from Mexico and runs the Auburn restaurant Tacos Mexico, was unable to secure any money from the first round of PPP funding, due to the amount of paperwork involved and the timing.

“Information wasn’t out there,” Zuniga said. “Everyone applied at once, and it was really hard to get. It was taking a long time with my application, and when they got back to me, they told me I didn’t apply on time.”

He eventually received funding during the second round of loans, obtaining $10,000. Zuniga said among other immigrant-owned businesses he talked to, the process was more or less the same.

“At the beginning, people weren’t ready for it. There was so much paperwork, and things like that,” he said.

Guardiola said SBA has put measures in place to ensure more equitable distribution. Later initiatives by the federal government, such as the Restaurant Revitalization Fund, put more priority for women and minority-owned businesses.

“They would be much more prepared now to reach out to smaller businesses,” said Guardiola. “If there ever was to be another wave, there would be some contingencies on that going forward.”