The good news in real estate is that the worst of the housing market mess from the last handful of years appears to be over, according to Leominster-based Foster-Healey Real Estate executive Rick Healey.

“I certainly think we’re on our way to recovery,” said Healey, a veteran of the North Worcester County real estate market. “It doesn’t appear there’s another shoe to drop at this point.”

The bad news: It’s going to take a while to fully recover.

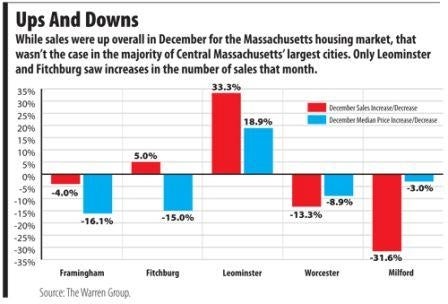

Recent sales figures from two real estate tracking groups — the Massachusetts Association of Realtors and the Boston-based Warren Group — showed that 2010 ended the year on a dismal note in the final quarter. The Warren Group said home sales were off 25 percent compared to 2009.

But along with the news came a glimmer of hope. December sales, according to both groups, were up about 6 to 7 percent compared to the same month a year earlier. And January home sales increased 13 percent year-over-year, according to MAR.

So is this a trend, or an aberration?

Signs Of Life

Winter is traditionally a slow season for home sales.

Despite that, there is some palpable momentum in the market, according to David Stead, MAR’s central region vice president, who is also a Worcester-based real estate agent with ReMax Advantage.

“When you talk to the Realtors, they are seeing more activity, no doubt,” he said. “That doesn’t mean we’re out of the woods, but it’s a positive sign.”

The key, he said, is to survive the cold-weather months and then hope that the momentum carries into the spring, when the market typically heats up as temperatures thaw.

Overall, the Central Massachusetts region has some catching up to do compared to the rest of the state. While MAR said home sales were off statewide about 1.2 percent during all of 2010, in Central Massachusetts they were down more than 5 percent, according to Stead.

But Timothy Warren, CEO of The Warren Group, warned that even if there are some lower-than-expected home sale figures for the next few months, that may not be a true indicator of the market.

Home sales for the first half of the year will be compared year-over-year to the first half of 2010, when the federal first-time homebuyer tax credit was extended, which boosted the real estate market. The Warren Group reported that January home sales were only up 5 percent compared to the previous year.

“We set a pretty high bar in the first half of 2010,” he said.

Healey, in Leominster, said even without government stimulus, he’s hopeful about the strength of the market.

“People felt really good about the $8,000- tax credit, but now people are realizing that a 4.5-percent interest rate is an even better deal for the long term,” he said.

Despite the optimism, there is still a lot of hurt out there.

Foreclosures and short-sale properties continue to plague the market and will keep home prices depressed for at least the next year to year-and-a-half, Healey predicts.

Falling home prices could actually be a good thing for a certain segment of the population, Northeastern University economist Alan Clayton-Matthews pointed out.

“It’s a great time to be a homebuyer,” he said.

MAR reported that January median single-family home prices continued to slide and were off more than 5 percent versus 2010 to end at $284,500. That was the second month of year-over-year price declines in a row.

As for the overall trends in the market, Clayton-Matthews said it’s really too early to tell if December’s sales increase is part of a trend. The true test, he said, will come in the spring.

“It’s a question that’s yet to be answered,” he told a gathering of business leaders in Southborough in early February. “We’ll just have to wait and see.”