Key players in the Central Mass. life science ecosystem are taking on a new initiative to help launch Worcester to the forefront of bioindustrial manufacturing.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Over the past decade, Central Mass. has been a key player in building out the life sciences economy statewide, and has solidified its position as a key region for that industry across the country. A smaller, less buzzy industry focused on bioindustrial manufacturing, however, may have the potential to launch Central Mass. to the forefront of related innovation, and bring the region’s economy with it.

Bioindustrial manufacturing advances well-known and regularly-used products – leather, plastics, concrete, for example – using biology. It’s not new to Worcester, with a small number of companies and academic researchers already focused on it, but its potential is still relatively untapped.

One example is Worcester-based SpadXTech, which uses cellulose materials to create products including insulation, filtration systems, and apparel.

The existing infrastructure that supports the life sciences industry could bolster biomanufacturing, said Jon Weaver, president and CEO of Massachusetts Biomedical Initiatives.

MBI and several other key players in innovation and research in the region are working on a plan to get it there. The life sciences incubator is leading a consortium involving the Massachusetts Technology Collaborative, Worcester Polytechnic Institute and other partners, to bring in federal funding that could accelerate the move.

The group applied for a grant from the U.S. Economic Development Administration that would declare Worcester a Regional Technology and Innovation Hub, but received notice on Oct. 27 that it would not be a recipient. Regardless of the decision, the consortium is making plans to move forward with the industry launch, said Weaver earlier in the month.

On a macro level, the timing for a new industrial boom may line up perfectly.

“We are in a really unique moment as a country,” said Ben Linville-Engler, chief investment strategist and program executive at MassTech. The American industrial strategy is poised to create big change and forward momentum, and the consortium wants to be at the forefront of it.

“We need to be proactive. We are a leader in biomanufacturing now, but we don't want to be stuck following behind later,” said Linville-Engler.

The interest in biomanufacturing has been on the increase, he said, with more and more related applications coming into MassTech. Using the solid base that already exists in the life sciences industry can help turn this interest into action, relatively quickly.

“This work wasn't early and foreign, it was everywhere,” said Weaver.

Leveraging the expertise, industrial mechanisms, and commercialization experience among those already in the life sciences industry is a likely approach forward, and is something that both Weaver and Linville-Engler have seen interest in.

“We were running into folks that had the expertise in the biopharmaceutical space looking to apply their skills outside of that,” he said.

While much of the skillset and development pipeline is similar between the two bio industries, there are differences in how products are commercialized and different potential economic outcomes, said Linville-Engler. Investment can close those gaps.

While biomanufacturing is a new subset for some, for Eric Young, assistant professor of chemical engineering at WPI, it has been a passion for well over a decade.

“I’ve always been excited about using biology to solve problems,” said Young. Biomanufacturing, from his perspective, can increase sustainability of products.

Joining the initiative with MBI was a product of realizing the economic potential of taking what is already known about using biology to produce therapeutics and applying it elsewhere, he said.

“We can leverage what Massachusetts is great at, and map it to a broader bioindustrial landscape,” said Young. “We can use the strong base we already have, and add in a few extra pieces.”

At WPI, this looks like expanding the curriculum specifically relevant to bioindustrial manufacturing career preparation so students have experience with processes and equipment.

The industry will not just be open to engineering graduates, however, said Weaver.

“People think of biological science as just for PhDs, but it can be an economic opportunity for everybody,” he said. “With a little bit of training, it can open an entire career path.”

Analysis from the consortium indicates that the industry has the potential to create almost 9,000 new jobs in the next 10 years, with the majority being available for non-higher education degree holders, said Weaver.

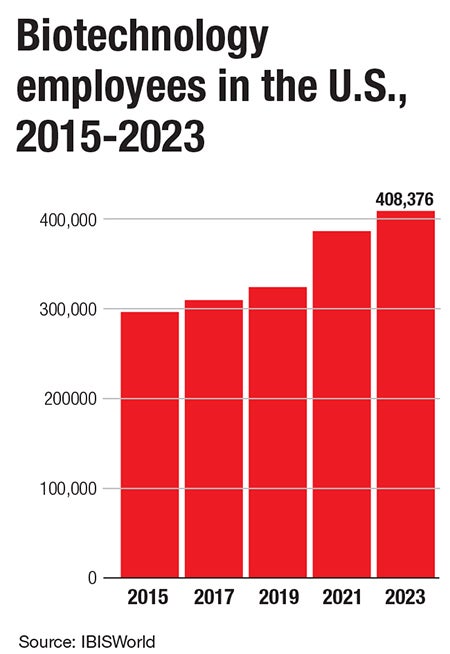

When the biotechnology industry took off, it created job growth of more than 100,000 positions, a figure that has steadily increased since 2015, and changed the landscape of development, employment, and real estate across Massachusetts, particularly in Boston and Cambridge. Weaver wants Worcester to play that kind of role in bioindustrial manufacturing.

Centralizing the efforts of all industry players in the region would leverage what Weaver called the raw materials that are needed for success.

“Central Mass. has a real right to win on this. We have the foundation, we have the talent pool,” he said. “If we put our flag out, we have the opportunity to lead this industry.”

But there is competition. Most Good Manufacturing Practice (GMP) facilities in the state are located within 30 miles of Boston, according to MBI.

MBI and the collaboration are developing a fertile environment for the kind of growth they envision, with the hope that in five to 10 years, the harvest will mean Worcester is heading the bioindustrial manufacturing charge, creating and keeping jobs in the region, and making Central Mass. a hot spot on the map.

“We don't want to be the place where companies just do research to scale and leave,” said Weaver. “We want to be where they stay forever.”