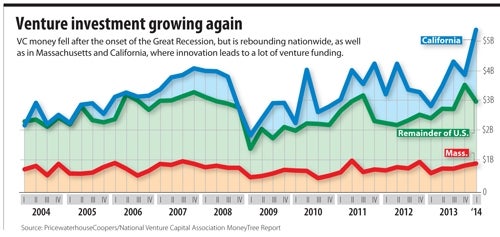

In the first quarter of this year, venture capital investment reached its highest point in more than a decade, with $9.5 billion going to companies nationwide in 951 deals, according to PricewaterhouseCoopers’ Money Tree report. Of that, $961 million was invested in Massachusetts, making the state the biggest recipient of VC funding relative to the size of its population.

Still, as anyone who has sought funding for a new company (at least since the end of the dotcom bubble) could tell you, finding an investor isn’t simple. For one thing, most of those billions of VC dollars aren’t going to startups but to more established firms that have already gotten funding in previous years. Only 13 percent of the Q1 VC dollars went to first-time financings, the lowest percentage in the survey’s 19-year history.

Here’s the good news: Investment players in Central Massachusetts say there are a lot of reasons to think that money is out there for new products with strong promise.

Convergent Dental Inc. in Natick, maker of a laser-based dental tool, was one of the recipients of venture money in Q1: $5.5 million. It was the fourth round of funding for the company from Massachusetts-based Long River Capital Ventures. The firm and the funder have had a very close relationship since before the company was even officially off the ground. Michael Cataldo, a former Long River partner, joined up with company founder Nathan Monty when the venture firm made its first investment in the company in 2010, and Cataldo serves as CEO today.

Caltaldo said Monty, now the company’s chief technology officer, hooked him from the start with the promise of a tool that could eliminate the use of dental drills. But he said getting funding demands not just a cool product but a “well thought-out, communicated business plan and strategy.” In fact, he said, that’s something every business founder needs, whether they’re seeking VC money or not.

“I think that it’s always a good time to be looking for funding,” Cataldo added. “If you have a really good idea and you can go through those things — understanding it, communicating it, it’s a good time.”

Send me an angel?

If venture capital isn’t readily available for a startup, or doesn’t seem like a good fit, angel investors are another option. Unlike venture firms, which invest on behalf of others, angels choose to put their own money on the line for a company — often a very young startup. Lisa Kirby Gibbs, chair of Boynton Angels, a Westborough-based group of individual investors, said angels’ willingness to invest has increased as the economy has emerged from recession.

“Typically, for angel investors, it’s money you’ve portioned to invest in a more risky portion of your portfolio,” Kirby Gibbs said. “The climate is good, I would say. We have more people interested in angel investing.”

Kirby Gibbs said there are 28 members of the group, which handles due diligence and legal processing but leaves the decision on whether to participate in any deal to each individual member. Boynton Angels makes a conscious effort to invest in Central Massachusetts companies, and Kirby Gibbs said it would probably be willing to hear a presentation from any Worcester County company that wants to make a presentation. She said the focus on the local area is partly a “pay it forward” thing, since most of the angels have built up their own businesses in Central Massachusetts, and partly a practical matter, because it’s easy to keep an eye on a local company. Still, Kirby Gibbs said the investors have ended up putting money into companies beyond the region simply because they seem more viable than some other, more local prospects.

Kirby Gibbs said some of the entrepreneurs who have presented for the Boynton Angels could have improved their results with a simple shift in focus: spending less time on the details of their products and more on business strategy. “They go in depth into how fabulous this product is, and that’s where they spend their 20 minutes, or the bulk of it,” she said.

Answer the key questions

Instead, Gibbs said, a successful presentation should address questions like who the competition is, how quickly invested money will be spent, and how the business expects to grow to profitability or be acquired.

Barb Finer, CEO of TechSandBox in Hopkinton, is in the business of helping companies figure out how to answer those questions. Her group, an incubator for tech startups, offers space and resources for new firms. Finer said one of the big lessons many companies she deals with need to learn is to seek out customers, winning early sales, letters of intent or other promises of a market, before developing a full product.

“That’s going to attract the money,” she said. “That’s the biggest thing … You really have to find the customers first.”

Mark P. Rice, who runs a “virtual incubator” for new companies at Worcester Polytechnic Institute, said the key for many entrepreneurs is to seek help and advice, networking and putting together a board of advisors who have experience in finding funding. “The entrepreneurs who are going to get the money are willing to admit they don’t know everything,” he said.

One thing some founders may not know is exactly what sort of funding is best for them. Don Bulens, president and CEO of Unidesk Corp., a Marlborough developer of virtual desktop management software, said the company started with an $8 million round of funding in 2008. (It recently raised $39 million in its fourth round). Venture money made sense for the firm, Bulens said, because it was building a complex product that required a team of more than a dozen employees. But for others, it might be smarter to start out slower.

“There’s a variety of different approaches that people can take to building businesses,” he said. “The entrepreneurs that I am most respectful of are those who bootstrap their businesses without funding or with only their own funding and are able to build organically. …. The key is to understanding what the funding requirements are going to be and then make choices about pursuing investment based on that.” n