In May, home sales in Massachusetts slowed to their lowest pace in almost two decades. In June, the sales skid itself seemed to slow, and in July and August, sales inched up ever so slightly as prices continued their downward trend.

Are these the beginnings of a housing market recovery, evidence of a normal, mid-summer rush fueled by the limited availability of the $8,000 federal first-time homebuyers tax credit, or a return to the fix-and-flip practice that played a key role in the inflation of the market in the early part of the decade?

Conflicting Reports

Across Central Massachusetts, opinions vary, with real estate executives claiming the market has put its worst days behind it and economists hopeful but restrained.

“The housing market has had mixed results, but I do think we’re onto something,” said Martha Meaney, an economics professor at Framingham State College and co-director of the college’s MetroWest Economic Research Center.

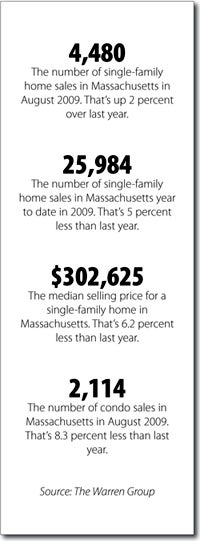

The numbers, according to the Warren Group, are this: Single-family home sales in Massachusetts hit 4,480 in August. A year ago, 4,390 single-family homes were sold. In July, home sales increased by 11 percent compared to a year earlier.

But August is traditionally a busy month for residential real estate, and Meaney said increases in the number of sale contracts signed in the next few months would be a better signal that the market is improving in earnest.

And Meaney said Central Massachusetts is particularly well-positioned to benefit from the eventual turn-around.

“Prices are generally lower (in Central Mass.) than statewide, and that’s good news,” she said. “And there’s a larger supply of homes out there for people who might qualify for the stimulus.” That is, less expensive homes more attainable for first-time buyers.

Towns in MetroWest, where Meaney concentrates her research, have also shown “mixed results.” She said some communities “are hot,” making it hard to tell how the market is doing in total.

Wouldn’t Be Prudent

Jeff Hall, president of the Worcester Regional Association of Realtors, said the association has seen prices begin to stabilize in the region, leading him to conclude that the worst is over.

“We’re surprised that values have held so strongly” in recent months, Hall said. “That’s good evidence that the market is turning around, but it’s not prudent to say that it’s going to happen quickly.”

And it wouldn’t be entirely prudent to think that shiny, happy first-time homebuyers are responsible for the market’s newfound stability. In fact, first-time buyers are often finding themselves shut out of the market by cash investors who seem to think prices are as low as they’re going to get.

Those cash investors have recognized an opportunity to begin flipping properties again, although now they may be credited with stabilizing the housing market rather than inflating it, as they did just a few short years ago.

“Cash investors are pouring money into the market, and right now, first-time homebuyers can’t compete with cash investors” when it comes to bidding on foreclosed, bank-owned or just plain cheap properties, Hall said.

“It may seem unfair, but they (cash investors) believe prices are at the bottom. They’re buying these properties and doing a total restoration. They’re taking something that is an eyesore for the neighborhood, doing a restoration or just updating and increasing the rents and maybe getting a better tenant,” Hall said.

First-time buyers are then considering homes that are just a little more expensive, and “a lot of the lower-end priced homes are moving,” Hall said. “Properties that are priced correctly, we’ve got multiple offer scenarios. Buyers were afraid of buying in a downward spiral, but now they see things are staying the same and they’re competing.”

Scratching The Bottom

With prices so competitive, potential buyers “have got to be all over this market,” said Matt Sosik, CEO of Hometown Bank in Webster.

But Sosik doesn’t expect the market to hit bottom just yet and doesn’t expect it to reach the highs that it reached just a few years ago ever again.

“I don’t think the housing market has bottomed because there’s still a lot of pressure because of the foreclosures still in the system,” Sosik said. But it’s close.

Statewide, foreclosures have been up and down thanks to a state law that requires lenders to give borrowers 90 days to avoid foreclosure before filing a foreclosure deed. Foreclosures dropped by nearly 60 percent in May compared to May of 2008, but then jumped by 9 percent in July and maintained a fast pace through August.

“I think we’re scratching the bottom, but home ownership rates will fall. It was propped up artificially high by overly liberal lenders, and to take that out of the system is a good thing,” Sosik said.

“Ultimately, we’re headed for a real estate market which is going to include a lower home ownership rate, lower prices and lower volume. What we had two or three years ago wasn’t sustainable because it wasn’t real.”