It isn’t heavily dependent on tourism or conventions, and it has relatively few hotel rooms. It isn’t home to any casinos and doesn’t host headquarters for any major airlines, energy companies, automakers or cruise lines, among others who have been hardest hit.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

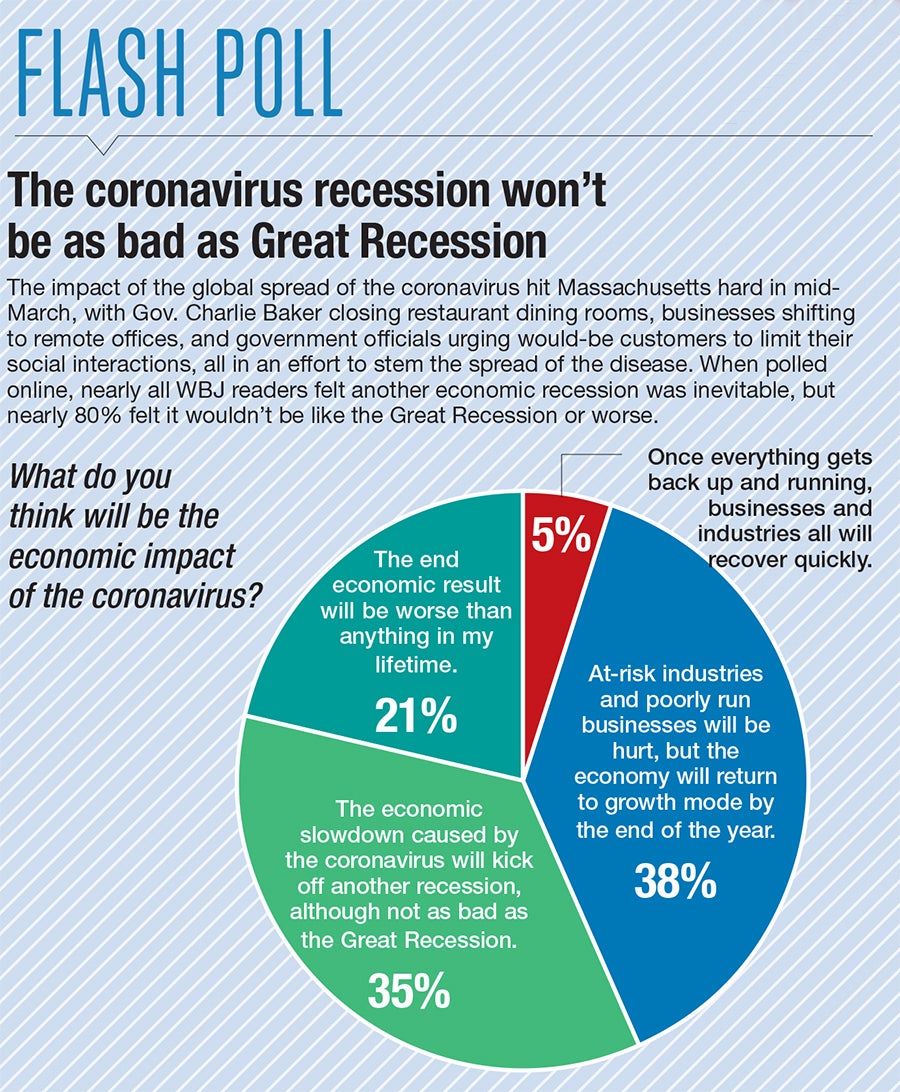

For more than a decade, the regional, national and global economies grew despite trade wars, rising home prices, growing college debt and a feeling a recession was bound to come.

Now, due to the coronavirus pandemic, a recession appears near.

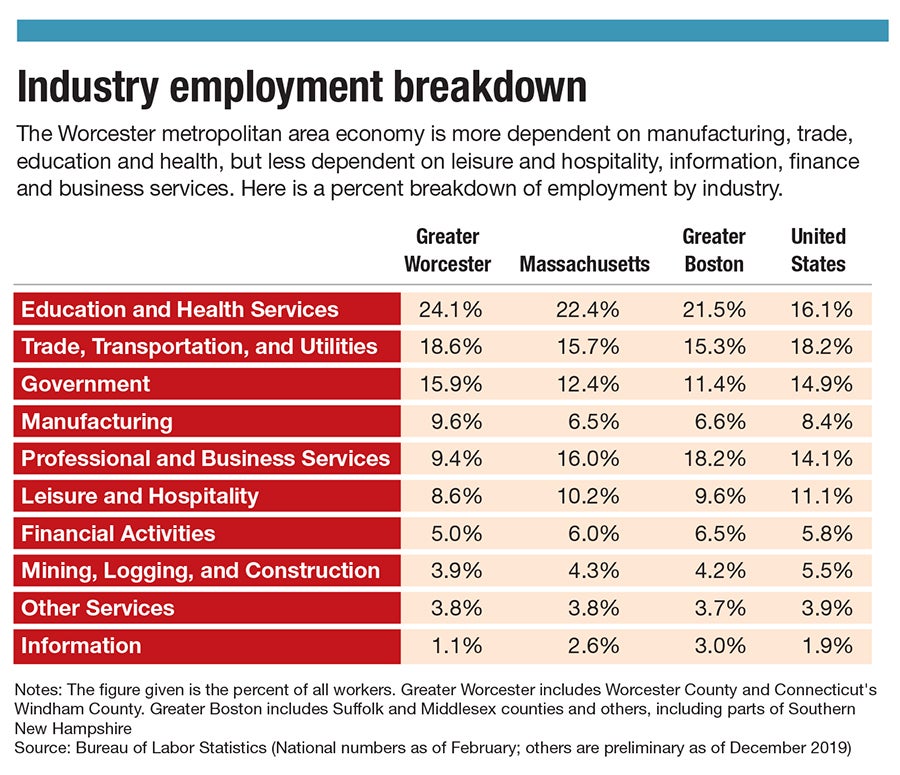

Greater Worcester may be better insulated than many other regions. It isn’t heavily dependent on tourism or conventions, and it has relatively few hotel rooms. It isn’t home to any casinos and doesn’t host headquarters for any major airlines, energy companies, automakers or cruise lines, among others who have been hardest hit.

But no region is safe from economic harm, particularly with countless small businesses having to close for the foreseeable future to help contain the spread of coronavirus.

“We’re not immune from any recession whatsoever, but I don’t think we’re going to get the worst of what’s coming,” said Robert Baumann, an economics professor at College of the Holy Cross in Worcester.

Prominent financial firms aren’t mincing words about how bad they expect the coming months to be economically.

J.P. Morgan of New York has predicted a 14% contraction in the U.S. economy in the second quarter, and Goldman Sachs of New York is expecting a 24% drop – revising that forecast from 5% days earlier. Wells Fargo Investment Institute, part of the San Francisco-based bank, forecasted what it called a short but deep recession based on the pandemic, as well as a sharp drop in worldwide oil prices.

Federal Reserve Bank of St. Louis President James Bullard was less optimistic. He told financial media outlet Bloomberg he expects the U.S. unemployment rate may hit 30% in the second quarter, along with a 50% drop in gross domestic product.

How Greater Worcester fares

How Worcester is affected can’t be illustrated by the same startling scenes as an empty Times Square or vacant Las Vegas casinos. But the city and Central Massachusetts are lined with small businesses economists say are facing a brutal period of time.

“It’s hard to tell at this point with all the uncertainty,” said Luis Rosero, an associate business professor at Framingham State University.

Traditional manufacturing – more concentrated in the Worcester metropolitan area than most – could be harder hit, he said. Unlike most office jobs, manufacturing work typically can’t be done from home, and Gov. Charlie Baker’s ban effective March 24 on non-essential employment and travel could greatly hamper those businesses, although a number of manufacturing firms were labeled as essential, including critical, military and chemical manufacturing.

But other prominent areas of the Worcester area’s economy, including health and education, are more recession-proof. That, and a relatively diverse economy, could help the area weather a downturn better than many other regions.

“There’s not too many eggs in one basket,” Baumann said.

Still, even companies with deeper pockets can be scared into delaying hiring, putting new building projects or initiatives on pause, or make consumers – whose spending makes up about 70% of economic activity – want to spend less.

There’s one advantage to what’s happened so far with the economy: rock bottom interest rates. That has led to refinancing activity at the banks.

“It’s exploded,” Ed Manzi, the CEO and chairman of Leominster’s Fidelity Bank.

Fidelity is working to help businesses with lending when possible, too, Manzi said.

The Federal Reserve dropped rates close to zero, while 30-year mortgage rates were below 3.4%. The Mortgage Bankers Association reported mortgage loan applications rising fourfold in mid-March from a year prior.

“They’re historically low rates,” said David L’Ecuyer, the president and CEO of Shrewsbury-based Central One Federal Credit Union. “If you go back 100 years, you won’t see rates this low. People are scooping it up.”

But there are challenges for Greater Worcester, especially since nonfarm employment has already been slowing.

Initial data from the U.S. Bureau of Labor Statistics showed employment peaking in February 2018 and declining since. While those numbers have since been revised, they still show a slower growth rate.

Greater Worcester metro area added 1,500 jobs in January from a year prior, for example, compared to 4,300 jobs from 2016 to 2017, according to BLS.

An analysis of U.S. Department of Labor data by New York City ratings agency Moody’s Analytics published in February placed the Worcester metro area 166th among metro areas with less than 1 million people, down from 70th last year. That fall was driven in large part by generally flat labor growth.

“The wealthier Worcester suburbs will fare better,” said Hans Despain, the chair of the economics program at Nichols College in Dudley. “Low-income areas in the city of Worcester will be hit especially hard.”

Hit to businesses large and small

The $2-trillion stimulus package passed by Congress in late March could come to the rescue of small businesses left with few customers or even having to close entirely for the time being. However, the stimulus package needs to spur customers to go back out to those businesses.

“If consumers don’t spend or become less confident, the whole thing falls down,” Roser said of consumer spending’s domino effect. “It wouldn’t surprise me if a lot of small businesses go out of business as a result.”

The New York City credit rating agency Standard & Poor’s has estimated the country’s restaurant industry shrunk in income by almost half just in the first half of March.

Bigger area firms have been hit hard, too, initially through supply chain disruptions from China, though how much isn’t yet clear.

Marlborough medical device company Boston Scientific said in an earnings report Feb. 5 – long before the impact on the United States was known – it expected coronavirus to hit its sales by $10 million to $40 million. Oxford laser manufacturer IPG Photonics said in an earnings report Feb. 13 it expects roughly $45 million in reduced revenue from the outbreak.

BJ’s Wholesale Club of Westborough, on the other hand, has seen its stock rise during the market’s sharp downturn thanks to consumer stocking up on household staples. A Brookings Institution report ranked the Worcester metro area 56th of 384 areas as among the least likely to be hit hard by coronavirus-related economic changes, based on the area's core industries.

Recovery, eventually

How quickly Central Massachusetts and the rest of the United States and the world recover depends on factors including how well coronavirus can be stopped, transmission and death rates, and what actions governments take for both public health and the economy.

Financial firms are largely projecting a quick return to economic growth, even if health experts have said the pandemic could last a year to 18 months.

J.P. Morgan, which predicts a 14% economic contraction in the second quarter, said it expects growth of 8% in the third quarter and 4% in the fourth quarter.

Despain, from Nichols, is less optimistic, because he said the trend for the last three decades has been more money going to high-income people at the expense of lower-income people.

“My sense is that after three decades of greater economic concentration in the U.S. economy,” he said, “this is going to make the economy even more concentrated.”