To many, the name Staples conveys one specific image: a high-ceilinged store full of neatly stacked reams of paper, packages of pens and a mind-boggling variety of printer ink. But the Framingham-based retailer is other things too, among them the nation’s second-biggest e-commerce brand, one of the top five retailers of consumer electronics in the country and perhaps the most obvious choice for any large corporation awarding an office supplies contract.

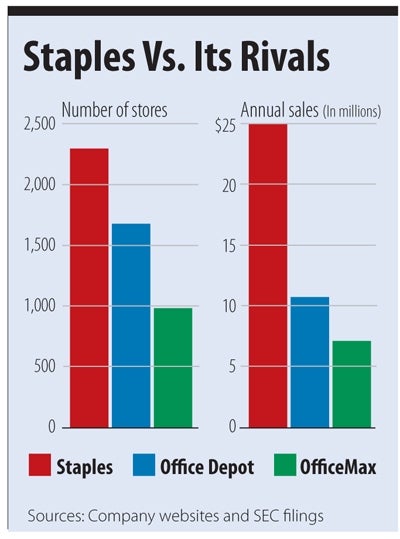

Since this month’s announcement of a planned merger of Office Depot and OfficeMax, there has been much discussion of the benefits Staples might gain if the merged entity closes stores around the country. But the questions around Staples’ future go well beyond that, to the ways both office and sales channels are changing.

Oliver Wintermantel, an analyst with ISI Group in New York, said Office Depot and OfficeMax could shut down from 10 to 30 percent of the more than 2,000 stores they operate. He said it’s certainly true that Staples is likely to get new sales at its own locations as customers look for a new place to shop.

But Wintermantel said it’s also good for the industry as a whole to see those stores close. With more customers doing their shopping online, he said, the market is oversaturated with office supply stores.

In fact, Staples is shutting down stores. In the third quarter of last year, it announced it would close 46 of its European outlets, and CEO Ronald L. Sargent said in a conference call that it’s reducing its North American square footage by 15 percent amid store closings, downsizing and relocations.

Stronger Web Emphasis

The corollary to shutting down those physical locations is growing the company’s online business, which already stands at $11 billion in annual sales.

“We significantly increased investment here over the past few years, but to really get the topline going, we need to move faster,” Sargent said.

To help make that happen, Staples opened what it calls the “Velocity Lab” in Cambridge last year, a space devoted to developing new e-commerce and mobile technology. Another piece of the company’s strategy is introducing many new products so customers have more choices. That’s something that’s difficult to do when you’re talking about stocking a finite physical store, but much easier on the e-commerce side.

Anthony Chukumba, senior analyst for BB&T Capital Markets in New York, sides with Wintermantel in that a reduction in the number of office supply stores would be good for Staples. But he also noted that the company still faces increased competition from expanding office supply departments at stores like Walmart and Target, and at pure e-retailers like Amazon.com. Chukumba said the Office Depot/OfficeMax deal will have an even larger impact on Staples’ large corporate contracts, which he estimates represent 35 to 40 percent of the company’s sales. Staples got into the business of supplying big companies when it bought Corporate Express in 2008, then rebranded it as Staples Advantage. Already, the analyst said, there’s not a lot of competition when it comes to Fortune 500 and Fortune 1000 contracts.

“When those contracts come up for bid, for the most part there’s only three companies on the table,” he said.

And Then There Were Two?

That would be Staples, Office Depot and OfficeMax. Other companies simply don’t have the scale in terms of customer service, account management capacity and national and international distribution, Chukumba said.

If the number of potential vendors for these contracts drops to two, he said, it means not just less competition but “less likelihood of someone putting in a completely irrational bid” to secure a contract, driving profitability down for everyone.

More Clout For Merged Firms?

Wintermantel had a more mixed view of the merger’s possible effects on corporate contracts. He said combining Office Depot and OfficeMax could give the merged company more clout to push vendors for better prices, which could help when it comes in contract bidding. But he said that, in the short term, some customers might also leave the two companies for Staples to avoid any disruption as they merge their distribution systems.

In general, the time and energy involved in the merger will be a factor in how much Staples benefits, and Chukumba said it’s not likely to go smoothly. He noted that Office Depot and OfficeMax have not yet said what the name of the new company will be, where it will be headquartered or who will be CEO.

“I can’t think of enough words to describe how unusual and bad that is” for the company, he said.

Chukumna said the companies have also not yet decided what brands they will keep, and they’re splitting the new entity’s board evenly between directors from each side, increasing the potential for conflict.

“There’s going to be infighting,” he said. “They’re going to be very distracted. It’s going to be an opportunity for Staples to pick up market share.”

Read more

Staples President, COO Stepping Down

Don Romine, President And CEO Of Web Industries In Marlborough