Falling rates: The Fed’s cut to interest rates will boost the Central Mass. economy, yet the impact may not be immediate

Photo | Adobe Stock

Photo | Adobe Stock

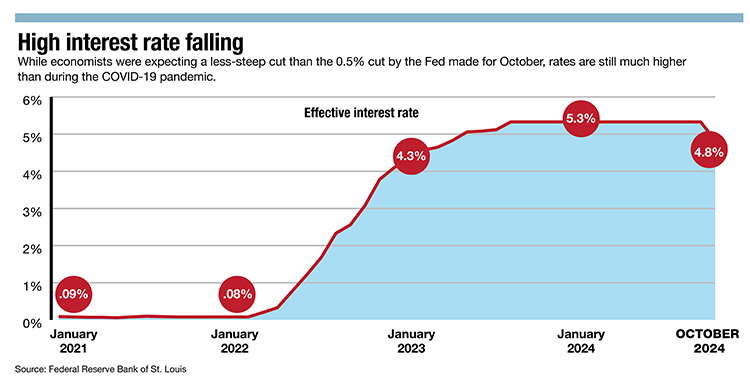

After the nation’s central bank had been telegraphing a rate cut for months, few people were surprised in September when the Federal Reserve decided to cut the federal interest rate to 4.83%, the first rate cut since the COVD-19 pandemic paralyzed the global economy in March 2020.

The interest rate had been at 5.33% for 289 consecutive days, the highest level since 2001 and a contrast to just a few years ago in 2021, when the country was still in the throes of the pandemic and the rate hovered just above zero.

In Central Massachusetts, much like the rest of the country, the most straightforward analysis of the rate reduction is it’s good news for people and businesses who are either looking to borrow or who are already paying down debt, but bad news for those savers who had previously enjoyed higher-than-usual annual percentage yields.

Financial insiders who shared their thoughts with WBJ on the rate cut are hopeful it will have a positive impact on consumer spending, small businesses, and the region’s efforts to build its way out of its current housing crunch.

A boost for housing?

While the fact a rate cut was imminent had long been telegraphed by the Fed, economists were taken back by the fact America’s central bank decided to go with a larger 50-basis-point cut, rather than a series of smaller cuts over the remainder of 2024; a Reuters survey found 92 of 101 economists were expecting just a 25-basis-point in September.

“I really anticipated a quarter [percentage cut],” said Mary McGovern, president and CEO of Country Bank in Ware. “It was a balance. I wouldn’t want to be in the Feds’ shoes given it’s an election year. They must have felt like the metrics and things that they follow were going in the right direction.”

Considering Central Massachusetts’ issues with rising home costs and surging rents, much of the local focus around the news of the Fed cut has been focused on its potential impact on the housing market.

The cut should be helpful to prospective homeowners, McGovern said, with some of the benefits of the much-anticipated rate cut occurring before it was even announced.

“In anticipation of the [new] rate, we’ve seen mortgage rates come down on 15- and 30-year mortgages, which is beneficial to anyone looking to buy a home,” she said. “Perhaps builders will build a couple more houses. When they’re borrowing to build, it’ll be a little cheaper for them.”

With the amount of Greater Worcester housing-related construction permits reaching a 10-year low in 2023, according to U.S. Census Bureau data, there’s a lot of room for improvement in the effort to build the amount of needed housing in Central Massachusetts. The crunch has caused businesses to struggle to convince talent to attempt to be a buyer or renter.

Lower rates might help turn the tide, although other factors are dragging down housing production, said Brian McEvoy, chief retail banking officer at Webster Five in Auburn.

“There’s not just the interest-rate impact, but other variables, like municipal zoning requirements, and the whole not-in-my-backyard movement impacting multifamily housing,” McEvoy said of the region’s housing situation. “Some of these projects in the last couple of years with the increased rate environment have stalled or paused. If the impact of rate reductions is significant enough over the next 18 months, that you can certainly see that come back.”

Big for small businesses

The positive impact for business is obvious, even if it will take some time to feel it, said Chris Geehern, executive vice president, public affairs and communications for trade group Associated Industries of Massachusetts.

“This is unequivocally good for businesses,” Geehern said. “At the same time, it’s likely to be a methodical process by which these changes kind of ripple through the economy. It's great news, but it will be a series of changes, or a slow and methodical transition.”

While it will take some time to feel the true impact, the lower rate will be a boost for industries ranging from financial services to manufacturing, particularly for companies looking to expand, said Geehern.

“It’s good for technology, bioscience, and manufacturing companies that are frequently in the capital markets looking to raise money,” he said. “Any capital-intensive businesses who tend to go out and borrow money, say to buy a new piece of machinery or put a new wing on their plant, for all of those companies it’s ultimately good news.”

For local businesses with variable-rate loans from the U.S. Small Business Administration, the rate cut could have a particularly meaningful impact, said Geehern.

“In July, the average APR on a SBA loan was 13.5%,” he said. “If you think about a 15-year SBA loan at $300,000 and you reduce that APR by just a quarter percent, it reduces your interest over the life of a loan by $9,000. For small businesses, that’s more than just pocket change.”

Consumer-focused businesses both big and small are hopeful shoppers will be ready to open their wallets even more than they have been, he said.

“Inflation has been so front of mind for consumers,” said Geehern, noting consumer spending had been surprisingly resilient even with the high interest rate. “It hits you everywhere. It hits you when you go to Dunkin’ Donuts. It hits you when you go to the grocery store. From a psychological standpoint, the sense that at least things are turning around will certainly help consumers.”

This holiday season hopefully will be a solid one for businesses, after several years of uncertainty, McGovern said.

“My guess is it'll be a strong holiday season, but it won't break any records,” she said. “As much as they hear about how bad the economy [supposedly] is, people are still going out to dinner and going on trips.”

Cautious optimism

Interest rates are an important influence over the economy, but they are not a major lever; global political strife and a myriad of other factors have the potential to undermine any positive impacts seen in the Central Massachusetts economy.

Despite the hopeful predictions for a positive impact from the rate cut, widening international conflicts and potential fallout from the upcoming presidential election results are still on people’s minds.

“Inflation and interest rates are two very important variables, but there's a whole lot of other stuff going on right now too that’s far away but still impacting us locally,” McEvoy said. “Geopolitical considerations, election uncertainty, all of those things that they make up, kind of a tapestry of impacts.”

While not a magic bullet for the economy, there are other positive indicators the economy is on solid footing post-cut; jobs figures for September released by the U.S. Department of Labor on Oct. 4 showed 254,000 jobs added in the month. Just like the size of the federal rate cut, this number surpassed the predictions of economic forecasters.

“The jobs report was very favorable, and that's positive for the economy,” said McGovern. “The last two months, job production across the country has been healthy. The unemployment rate is down. So the economy seems to be responding positively to the cuts.”

Eric Casey is a staff writer at Worcester Business Journal, who primarily covers the manufacturing and real estate industries.

0 Comments