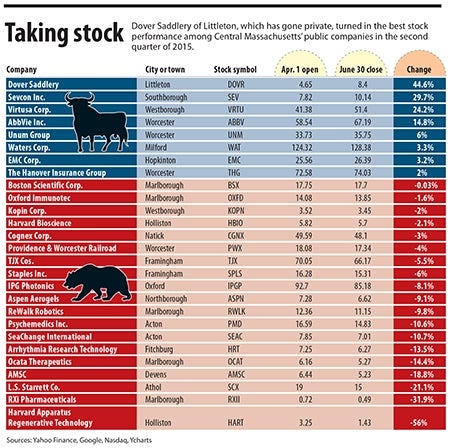

(Taking Stock, published in the first issue of the Worcester Business Journal each quarter, highlights the market performance of public companies that

are either based or have a significant presence in Central Massachusetts.)

Amid a relatively flat second quarter for U.S. stock markets, there were a handful of Central Massachusetts-based companies whose shares did well between April 1 and June 30, led by Dover Saddlery of Littleton.

But the equestrian products retailer, whose stock gained nearly 45 percent, is no longer a public company. On July 1, it became part of Waltham-based private equity firm Webster Capital, at a payoff of $8.50 a share to company stockholders, a dime higher than its closing price for the quarter. Dover’s stock soared to the $8.50 level in April, when the deal with Webster was announced, and held on. The stock ceased trading as of July 7.

Yet Dover went out with a bang during the quarter, opening new stores in Connecticut and California.

Among other stocks …

Shares of Sevcon, of Southborough, gained close to 30 percent after the maker of microprocessor-based controls for hybrid and electric vehicles saw a 13-percent jump in revenue for its previous quarter. Sevcon also announced plans to add 20 jobs after it landed a $600,000 grant from the British government to develop new products.

Staples lost 6 percent during the quarter as it moves toward its intended merger with chief rival Office Depot. Stock in the Framingham-based office supplies retailer peaked at $19.01 a share when the $6.3-billion deal was announced in February. But it quickly fell to a level it hadn’t seen in nearly two years.