Sales at BJ’s Wholesale Club doubled at one point early in the coronavirus pandemic as part of a rush of business to warehouse clubs, according to an industry tracker.

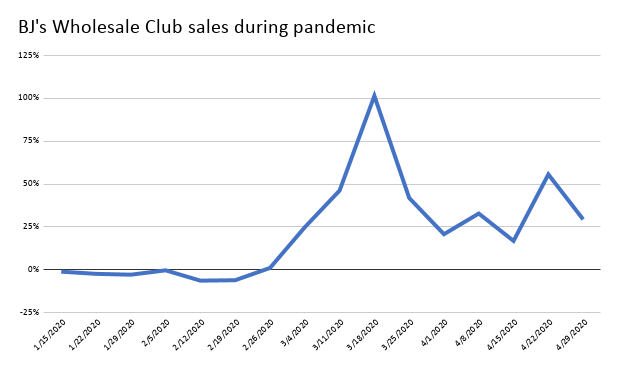

BJ’s saw sales jump 25% at the start of March and only rise from there, according to findings by Earnest Research, a New York data analytics firm tracking metrics at thousands of companies. Sales peaked at more than double its mark of a year prior in the week ending March 18.

Sales have stayed high since, including through a 29% year-over-year increase in the week ending April 29, Earnest’s data shows.

Revenue has also spiked, though to a lesser degree, at a main warehouse rival: Costco, based in Washington. Costco’s sales peaked in the same week as BJ’s but at 53% higher than last year’s numbers.

Warehouse clubs have seen brisk business at a time when other retailers have been forced to close entirely for the time being or as customers have stayed away. Retail sales nationally in April fell by 16.4%, according to U.S. Census Bureau data released Friday. That followed an 8.3% drop in March.

April sales numbers weren’t available for warehouse clubs, but grocery stores, which share similar basic-necessity offerings, saw sales rise 13.4%. It was the only major retail sector to see sales rise for the month other than online stores.

BJ’s is scheduled to release its first-quarter finances on Thursday.