Two Central Massachusetts small businesses have turned to alternative, community-based fundraising methods to support their expansion efforts.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

Operating a small business has never exactly been easy. The U.S. Bureau of Labor Statistics reports one in five businesses fail within their first year and 50% of small businesses fail within five years.

Sobering numbers for budding entrepreneurs.

The rising costs of real estate, goods, and labor have made it harder to sustain a business, nevermind grow one, especially with limited access to capital.

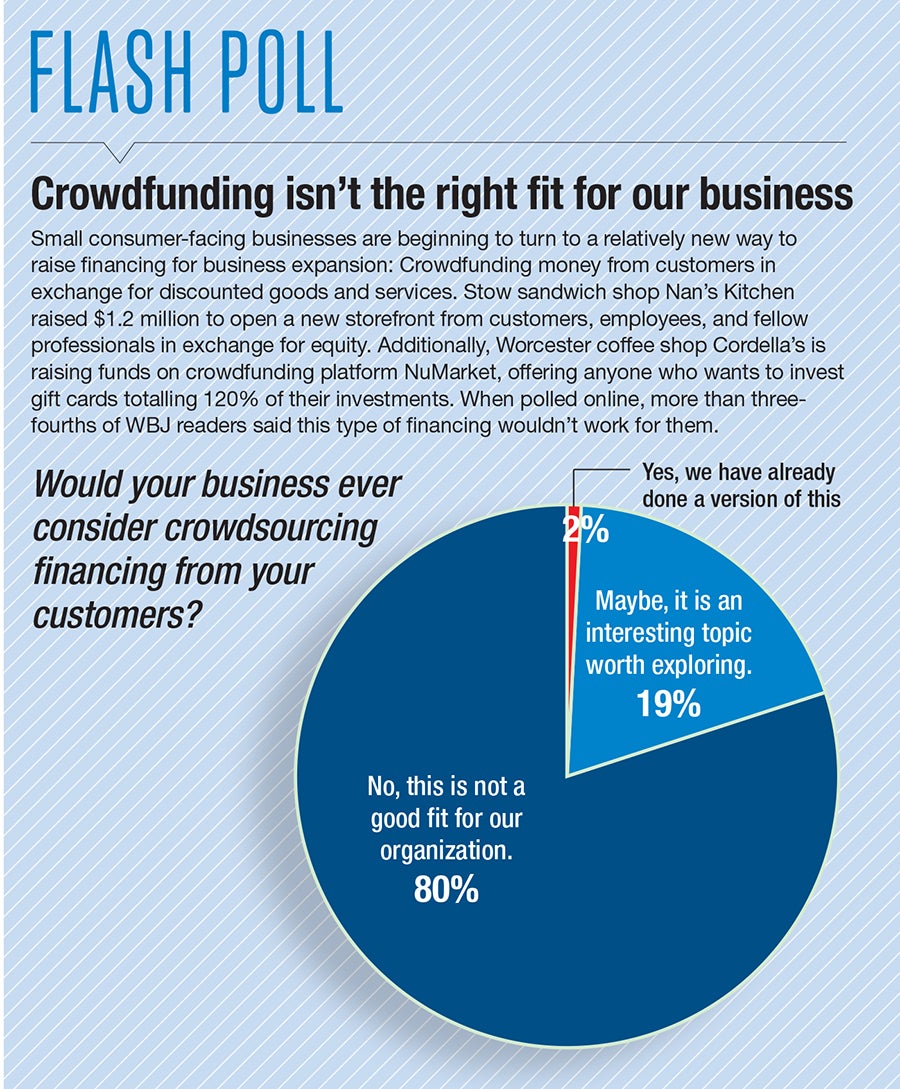

To solve this problem and help grow their burgeoning customer bases, two Central Massachusetts small businesses have turned to alternative, community-based fundraising methods to support their expansion efforts. Essentially, they are asking customers and others in the community to provide them with money, in exchange for equity or discounted goods and services.

“If we invest in each other, in the communities, we stand to really win big time,” said Jordan Mackey, owner of the restaurant Nan’s Kitchen.

Nan’s, which operates locations in Stow, Southborough, and Westford, announced in January it had raised $1.2 million through an exemption under the U.S. Securities and Exchange Commission, offering an equity stake in the business in exchange for investments.

The exemption allowed the company to fundraise from accredited and up to 35 non-accredited investors that Nan’s had already had pre-existing relationships with.

Because financers didn’t need to be accredited, which includes meeting certain financial benchmarks outlined by the SEC, Nan’s was able to obtain investors such as employees and customers, those with a vested interest in seeing the company succeed. Operating under the exemption also meant the restaurant couldn’t advertise its fundraising to the general public, and instead had to work within its connections, which included anyone who had previously ordered from its shops.

Nan’s ended up accruing 45 investors in exchange for about 9% equity in the company.

Raising community capital

Mackey had originally wanted to go the bank financing route to support his expansion.

“As a founder, everyone tells you 'Don't give up ownership in your company,’” he said.

But taking a critical eye to his business plan, he realized that sentiment didn’t fit within his goals.

“I don't need to own this much of it. I'm not planning to do this for 40 years,” he said.

Furthermore, unlike partnering with community members, loans and lines of credit aren’t collaborative ventures, and they come with strict oversight and regulations.

“They don't give you advice. All they do is charge you interest and make it really difficult for you to spend the money that they're loaning you,” said Mackey.

Instead, Nan’s now has 45 new investors, which means 45 more people’s families coming in for sandwiches, ordering for their pool parties, and telling their friends about their ownership in a local establishment. The crowdfunding method comes with built-in marketing.

Like Mackey, the owners of Worcester cafe Cordella’s had considered more traditional financing options to fund their expansion project, like taking out a small business loan, but ultimately felt that approach didn’t align with their operational goals.

They didn’t consider well-known crowdfunding platforms such as Kickstarter and GoFundMe for a number of logistical and strategic reasons. For one, Kickstarter mandates that a campaign must reach its full goal in order for its organizers to receive the funding. Secondly, the owners have observed platforms like GoFundMe are more commonly used for emergency and/or acute situations, rather than initiatives like expansion projects.

In an effort to best utilize their space to generate income in the evenings, Cordella’s co-owners Alecia Bishop, Andy Jimison, Jessica Rao, and Ellie Ellis are planning to broaden their shop’s business model to include cafe service during the day and operate as a wine bar in the evenings. This will include knocking down both walls on either side of its cafe to incorporate the adjacent storefronts, move the bathroom, and renovate the area into one large, open layout.

“The focus of utilizing a space for multi purpose is a big thing now,” said Bishop. “It's just the way that craft coffee is going.”

In order to fund this heavy lift of a renovation, Cordella’s owners turned to the crowdfunding platform NuMarket.

“We wanted to do something that had value for people who were going to contribute, which is why NuMarket was a standout option for us,” said Bishop.

NuBeginnings

Ross Chanowski founded the Boston-based NuMarket in 2021 after noticing he and his fellow small business owners all had one thing in common: lack of access to financing, or at most, terrible financing. At the same time, those businesses had lines down the block and a strong, loyal customer base.

“I kind of wanted to put those two things together and help turn everyday customers and real people into the financiers of great, small businesses,” said Chanowski.

Thus, Chanowski launched NuMarket. The online platform allows small businesses to run crowdfunding campaigns for needs including expansion projects, purchasing essential equipment, and working capital. Anyone can contribute any amount of money to their campaign of choice in exchange for 120% of that contribution in credit to be used at that business throughout six monthly installments.

“You're really paying back your customers, the people who you want to come through the doors more often, and that money stays in the community,” said Chanowski.

As opposed to using institutional lenders, such as banks where interest rates can be in the double digits, NuMarket solely keeps 12% of the funds raised as payment.

“If you're paying back more every month to not only a stranger, but essentially, just a large corporation that isn't really paying attention, that's not necessarily really helping your business in the long term,” he said.

After Cordella’s owners spoke with Chanowski, they knew NuMarket’s model was the right place to take their fundraising goals.

“It just felt like a win-win for everyone,” said Bishop.

NuMarket helped prepare Cordella’s before its campaign went live and has continued to provide support and guidance including help with campaign structure, graphics, and copywriting.

Since the launch, Cordella’s has seen a noticeable increase in both business and engagement, in–person and online.

“It's not like they're just donating to this page on the internet,” said Jimison. “So many regulars and new people have come in and just asked us questions about it and talk to us face to face.”

Those conversations often include how the campaign works and how Cordella’s ends up making money even with the 120% credit. Bishop said that food and beverage businesses ideally earmark 30% of a price tag for the cost of goods with the remaining 70% consisting of labor and operational costs and profit. So while someone who invested $100 will get a $120 gift card, Cordella’s isn’t losing $120 in goods and labor in return.

Additionally, the campaign’s structure to offer the credits on an incremental basis safeguards Cordella’s from being hit all at once thousands of dollars worth of credits.

Growth in motion

As of April 23, Cordella’s had raised $24,513 from 209 contributors toward its $50,000 goal. While the campaign was supposed to conclude at the end of April, NuMarket offered Cordella’s an extra week of fundraising time, meaning contributors now have until May 7 to invest.

The shop plans to begin preliminary work on its expansion in May and hopes to start construction by June 1.

Before it launched its crowdfunding campaign, Nan’s was growing at a rapid clip: its eateries generated more than $2 million in its first year of business, $2.5 million in its second, and $2.7 million in its third. Mackey then decided to plan for longer-term, larger-scale expansion.

Mackey set a goal to raise $1.2 million, which the company will match to open four more Nan’s storefronts throughout the state, aiming to operate 12 total shops within the next five years.

“It kind of enabled us to continue to grow under the merits of our own cash flow, at least at a certain speed,” said Mackey.

He knows this model of financing won’t be sustainable indefinitely. As the chain grows and continues to raise larger and larger sums of capital, it won’t be possible to have conversations with the number of investors it will take to raise the likes of $5 million or $10 million in exchange for equity.

“Obviously, we're going to be looking for larger investors at some point, but we want to continue to be able to have the community participate because how cool would that be to invest in your favorite restaurant and wind up making money,” he said. “There's tons of people out there. They're trying to build wealth for themselves and change the dynamic of how they do it. And the best way to do it is to invest in things you believe in.”

Mica Kanner-Mascolo is a staff writer at Worcester Business Journal, who primarily covers the healthcare and diversity, equity, and inclusion industries.