The overwhelming majority of Bay Staters continue to have health insurance coverage, but a new survey highlights nagging challenges in accessing care and affordability woes exacerbated by high-deductible plans.

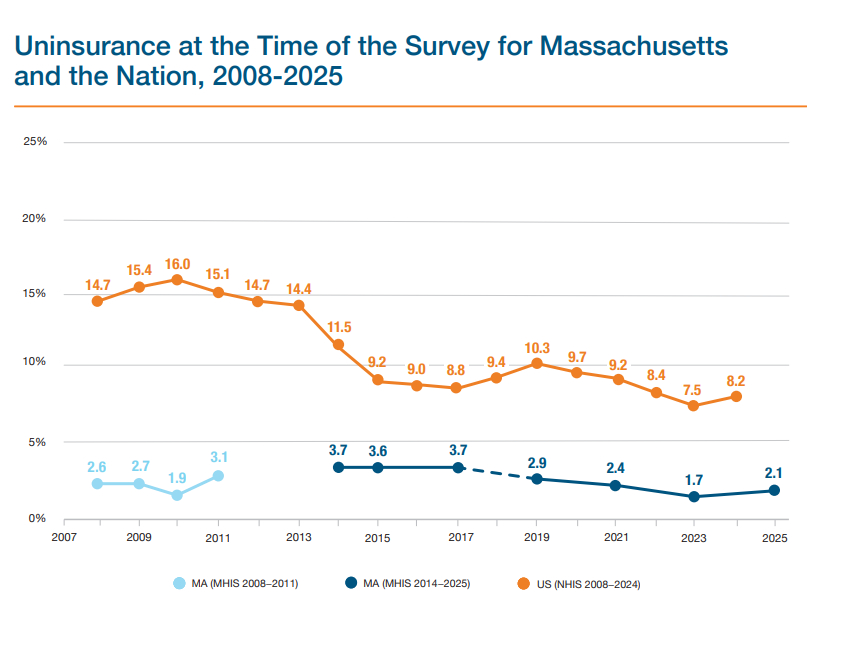

The uninsured rate in Massachusetts is 2.1%, compared to the national rate of 8.2%, according to the biennial Massachusetts Health Insurance Survey released Thursday. Nine out of 10 residents also reported continuous insurance coverage for all family members living in their household over the past 12 months.

A 2006 reform law signed by former Gov. Mitt Romney was crafted to facilitate universal insurance coverage.

But health care affordability issues persist, and about 28% of residents said they or a family member in the past 12 months refrained from seeking care due to the cost.

The Center for Health Information and Analysis said it conducted the survey between January and April and completed interviews with 5,365 households. The survey was partly funded by the Blue Cross Blue Shield of Massachusetts Foundation.

“In light of impending federal health care policy changes, it is more critical than ever that we confront the intertwined challenges of access and affordability in Massachusetts,” CHIA Executive Director Lauren Peters said.

The 2023 survey found 98.3% of residents had insurance, compared to 97.9% in 2025. Based on the latest survey, 139,741 Massachusetts residents are uninsured, said CHIA spokesperson Emma McNamara.

Health officials forecast massive coverage losses across MassHealth and the Massachusetts Health Connector amid federal policy changes, and Beacon Hill leaders have yet to hash out plans to mitigate disruptions to care. More than 10,000 Health Connector members have dropped coverage during the insurance exchange’s ongoing open enrollment period, as they face surging premiums tied to the looming expiration of federal tax credits.

The majority of uninsured residents were ages 19 to 64, which CHIA said underscores the availability of MassHealth for children and Medicare for adults ages 65 and older. A disproportionate share of uninsured residents were Hispanic, male or had a family income below 300% of the federal poverty level.

The steep cost of coverage and not knowing how to get insurance were the most common reasons for being uninsured, according to the survey. Residents must have insurance under state law or face a tax penalty.

The state’s uninsured rate is expected to double under Medicaid changes embedded in the One Big Beautiful Bill Act, Audrey Shelto of the Blue Cross Blue Shield of Massachusetts Foundation estimated last month.

“Even with near-universal coverage, many people continue to struggle getting care when they need it or delay care because of cost, and the problem is magnified for marginalized communities,” Shelto, the foundation’s CEO, said in a statement Thursday. “These findings will help policymakers focus on the issues that are getting in the way of timely, affordable care.”

Around 46% of commercially insured residents said they had a high-deductible health plan, which the Internal Revenue Service defines as having a deductible of at least $1,650 for individual coverage or $3,300 for family coverage. Deductibles “may result in higher out-of-pocket expenses when receiving care as the deductible must be paid before the plan covers certain services,” the report says.

Nearly 90% of residents with medical debt said they incurred that debt while they and all their family members had insurance. About 72% attributed their debt to deductible payments, and more than half of residents said their debt stemmed from copays or coinsurance.

The share of residents struggling to pay their medical bills or being unable to pay them is trending downward, the report points out. The percentage was 19.6% in 2014, compared to 13.7% in 2025.

CHIA found that residents who earned below 139% of the federal poverty level had some of the lowest rates of medical debt. CHIA said that trend “may reflect that MassHealth has eliminated all copays and cost-sharing for members below 139% FPL” and ConnectorCare “has eliminated copays for primary and behavioral health care as well as for specific drugs treating hypertension, diabetes, asthma, and coronary artery disease for members.”

Administrative issues related to health care and coverage also plagued one in five Bay Staters in the last year. Resolving a bill with insurance was the top complaint, followed by residents struggling to get information about their coverage from insurers, resolving a bill with providers and problems with obtaining prior authorization.

The survey found 87.5% of residents had a “usual source of care” and 90.4% had a primary care provider. Broken down by race and ethnicity, 92.4% of white residents had a primary care provider, compared to 87.4% of Black residents and 83.7% of Asian residents.

Still, about 43% of residents experienced difficulty accessing care. Some 30% of residents had problems accessing primary care, including securing an appointment as soon as needed, administrative hurdles and dealing with recent office and clinic closures.

The Senate in 2026 is expected to tackle a primary care bill. Reformers for years have been urging lawmakers to pass bills that will reinforce the primary care field, shorten wait times and improve access to basic care.

More than one in five residents had a behavioral health care visit in the past 12 months. The survey found that more than one in six residents paid for appointments fully out of pocket, largely because their provider either didn’t accept any insurance or didn’t take their plan.

Some 10% of residents said they had an unmet behavioral health need in the last year, with 5.4% attributing that to the cost of care.

Just under one in four residents reported going to the emergency department in the last 12 months, which is below pre-pandemic levels. Nearly one-third of residents said those visits could have been avoided if a non-emergency provider was available. CHIA said there were no “statistically significant” differences in ED visit rates between 2021, 2023 and 2025.