When President Joe Biden’s administration dropped a planned $600 reporting requirement on bank account transactions, financial institutions across Central Massachusetts and the nation breathed a collective sigh of relief.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

When President Joe Biden’s administration dropped a planned $600 reporting requirement on bank account transactions, financial institutions across Central Massachusetts and the nation breathed a collective sigh of relief.

Not only were banks and credit unions concerned about the amount of work that would go into tracking and reporting the originally proposed $600 rule and then its later modified $10,000 successor, but they were worried about their customers' privacy and undoing the inroads they made to historically unbanked populations.

“That kind of defeats the purpose of trying to lift up the backbone of America. This suppresses that and makes it more difficult to succeed,” said Ryan Foley, partner at the Worcester tax consulting firm Cunningham & Associates.

The original proposal was part of the Biden Administration’s effort to raise more money for its proposed federal spending programs by helping the Internal Revenue Service increase enforcement against individuals and businesses who underpay their taxes, by a combined estimated $600 billion annually.

To address this tax gap, the U.S. Treasury Secretary Janet Yellen proposed requiring banks and credit unions to submit reports on account transactions consisting of at least $600 worth of financial activity, including every withdrawal, deposit, and account to account transaction made by an account holder. After institutions such as the American Bankers Association and the Credit Union National Association said this threshold would apply to nearly every account holder in the nation, the threshold was raised to $10,000, before ultimately being scrapped.

“What is our right to privacy? We are law abiding citizens. We are reporting all of [our] taxes. We work with a tax accountant to do all of this correctly, and now somehow we are presumed to have done something wrong because of this vast data that is being submitted to the IRS,” Kathleen Murphy, president and CEO of Massachusetts Bankers Association, said about the former proposed IRS threshold.

Increased costs for banks

Financial institutions utilize vast data to manage and protect the personal information of account holders. Firewalls and core processors, third-party operators who provide banks with these informational systems, are in place now for everyday banking needs. However, these core processing systems would have needed to be reworked in order to pull all of the account information mandated by the proposal before transmitting that information to the IRS. These changes would have raised operating costs for banks while escalating tax preparation expenses for small businesses.

Mark O’Connell, president and CEO of Avidia Bank in Hudson, which has $2 billion in assets, said banks already contend with strict reporting.

O’Connell said the Banking Secrecy Act already requires financial institutions to report cash transactions of $10,000 or more to the federal government in order to prevent money laundering. During a 1996 addition to the Banking Secrecy Act, banks were further mandated to flag suspicious cash transactions, even if they were under the $10,000 limit.

“The BSA monitoring we do, we do not get compensated by the government for that, and we have a department at our bank of seven people who work in our BSA department. Their work is primarily, 80% to 90% of it, is to monitor accounts for suspicious activity and report on it for the government, which is why I am somewhat confused why [the IRS] need this new information,” O’Connell said.

Changing the reporting requirements would have had an impact on small businesses, said Foley of Cunningham & Associates, while not necessarily deterring bad actors who don’t pay their full tax obligations.

“If people are doing the wrong things, they are going to keep doing the wrong things. If they are not going to report income, they will continue not to report income. The reporting requirements are only going to put a strain on folks that are compliant and good taxpayers and good business owners,” Foley said.

Undermining confidence in banking

In 2015, the IRS was hacked, and the social security numbers of nearly 700,000 Americans were compromised. This history undermines people’s confidence in the government to keep their information secure, said Murphy.

If banks and credit unions were required to give over more information about account holders, then people would be less confident in financial institutions, too, she said.

“Our industry puts protection of consumer data at its highest priority, and quite frankly the banking industry under the Gramm-Leach-Bliley Act has the most consumer privacy requirements compared to any entity, any business in the country and we take that very seriously,” she said.

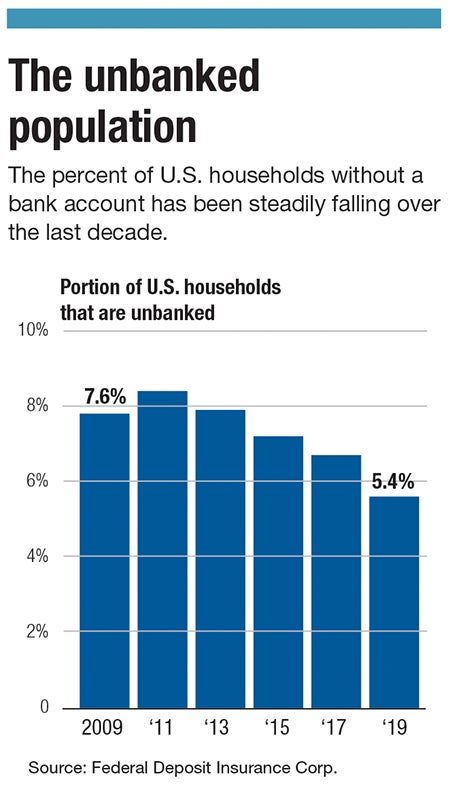

According to a 2019 survey from the Federal Deposit Insurance Corp., 95% of all American households utilize a bank or credit union account. This figure is the highest number and percentage of accounts since the survey was first conducted in 2009.

Still, 7.1 million households remained unbanked, according to FDIC

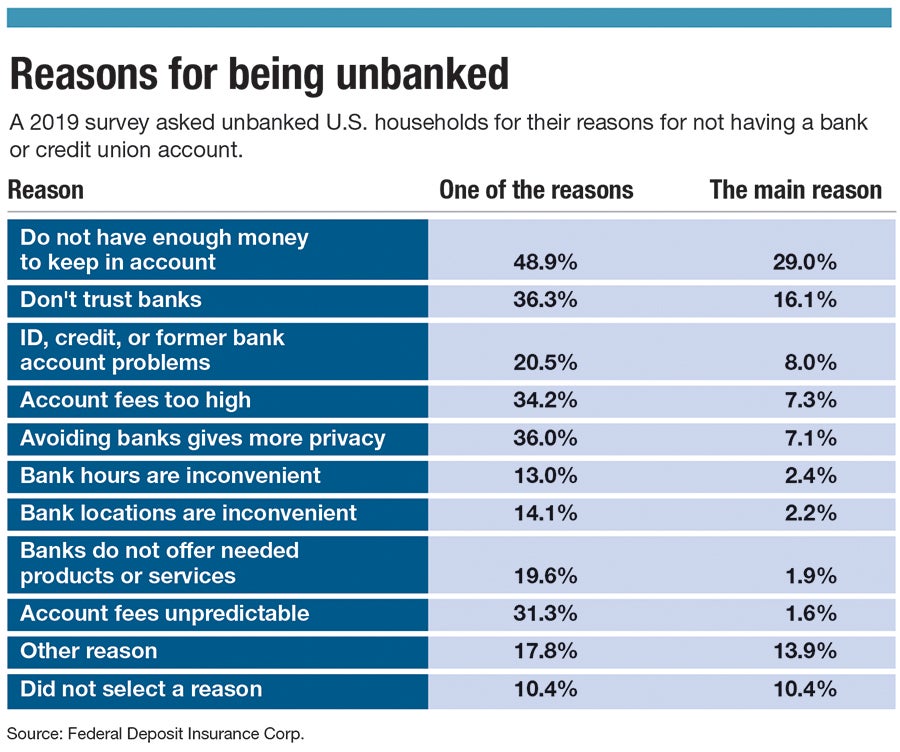

This aspect of undermining trust would especially impact credit unions since they serve people who typically cannot access traditional banking services.

“Credit unions have a rich and proud history of serving the underserved,” said Ronald McLean, president and CEO of the Cooperative Credit Union Association.

Credit union stakeholders sent nearly 600,000 messages to Congress expressing concern over the proposed additional reporting requirements, said Barbara Mahoney, president and CEO of Leominster Credit Union.

“We feel that Congress should not pursue these goals with a program that will almost certainly discourage financially vulnerable individuals from seeking out financial services from the safe and regulated financial services sectors. We work very hard to make financial services and products affordable and accessible,” Mahoney said.

Facilitating mistrust among the financially vulnerable, privacy, and increased costs for banks/credit unions are all concerns McLean had about the abandoned IRS reporting requirements.

“Every dollar spent on compliance is one less dollar spent on serving your members,” he said.