In March, Natick medical device maker Boston Scientific (BSX)announced it would acquire implantable defibrillator company Cameron Health Inc. for up to $1.35 billion. That’s a significant deal for BSX, which did $7.6 billion in sales in 2011.

But buying up other companies is a big part of how the company has been doing business for a while.

The company’s more recent acquisitions — at least six of them since late 2010 — have been driven by a restructuring plan. But analysts say the kinds of deals it has made are also fairly standard practice for big medical device companies: it’s a big way growth gets done.

Rick Wise, life sciences analyst at investment bank Leerink Swann, said companies like Boston Scientific, such as Abbott, want innovative companies.

“The medical device industry is on the hunt for growth, and you drive growth through innovation,” he said.

Wise said some of BSX’s recent acquisitions look promising. In late 2010, the company bought Asthmatz, which had developed an office-based procedure to help asthma patients. In January 2011, it bought the 86 percent of aortic valve replacement company Sadra Medical that it didn’t already own. Wise said both those areas of medical device manufacturing are good ones for BSX.

Problems With Core Products?

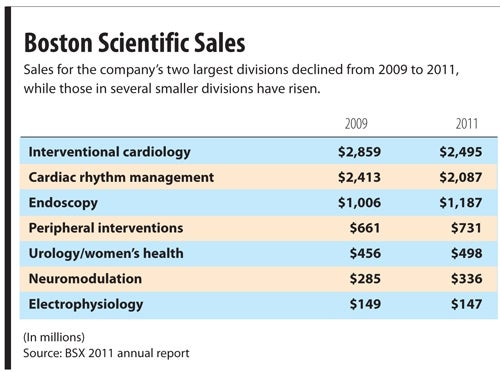

Rajeev Jashnani, an analyst with financial services firm UBS, said Boston Scientific has been pushed to move into new markets because some of its core products are having trouble. He said there’s less growth in demand and more pricing pressure on implantable cardioverter-defibrillators — something Cameron Health hopes to combat by producing a better, simpler version of the devices. Jashnani said buyers are also looking for lower prices on drug-eluding stents, a major BSX product.

“Their core businesses are probably under perhaps a bit more pressure than some of their competitors in terms of their performance,” Jashnani said. “But it’s really not all that unique to Boston Scientific.”

Jashnani and Wise said the industry landscape involves the biggest medical device makers, including BSX, buying some of the smaller players. The acquisitions are typically fairly large, with the big companies looking to buy not just innovative technology but products that already have fairly developed markets.

Wise said the financial and regulatory processes that medical device companies need to deal with are expensive enough that small companies, making being acquired an attractive option.

And, on the other side, Jashnani said the big players need the infusion of new products, even as they continue to develop technology internally.

“I think it’s a challenge for all large companies to continue to be innovative,” he said.

Other forces are also encouraging the entire industry to be as quick and efficient as possible. For one thing, Jashnani said, the people buying medical devices are now more eager to keep prices down.

“The hospitals aren’t flush with cash,” he said.

Boston Scientific appears to be eager to keep on doing more deals after the Cameron acquisi tion is complete. In a conference call with investors discussing the company’s first-quarter 2012 results, CFO Jeffrey D. Capello noted that Moody’s recently raised the company’s credit rating to investment-grade status with all three rating agencies. Capello also pointed to a new $2-billion revolving credit line. That means more available cash for growth, and a lot of that growth will probably come from new acquisitions.