Veterans face added challenges in financing a business, and at least one local credit union is seeking to make business loans more accessible for entrepreneurs who have served in the military.

Get Instant Access to This Article

Subscribe to Worcester Business Journal and get immediate access to all of our subscriber-only content and much more.

- Critical Central Massachusetts business news updated daily.

- Immediate access to all subscriber-only content on our website.

- Bi-weekly print or digital editions of our award-winning publication.

- Special bonus issues like the WBJ Book of Lists.

- Exclusive ticket prize draws for our in-person events.

Click here to purchase a paywall bypass link for this article.

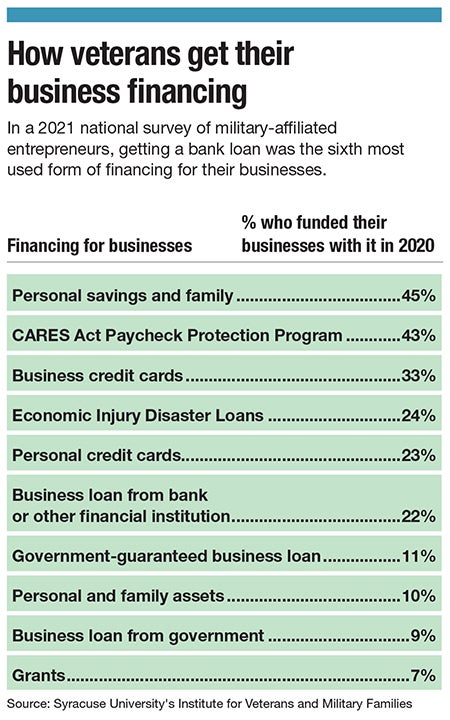

It’s never easy to get a business loan when you’re a fledgling entrepreneur. According to Federal Reserve Data, 31% of small businesses nationally received all of the funding they sought in 2021, and the number of business owners who even applied for traditional financing is steadily dropping as borrowing becomes more expensive.

Veterans face added challenges, and at least one local credit union is seeking to make business loans more accessible for entrepreneurs who have served in the military.

Peter Rice was hired as president and CEO of Hanscom Federal Credit Union 18 months ago, in part because of his experience with business lending programs targeting veterans. Headquartered in Littleton, Hanscom FCU has locations in major U.S. Department of Defense buildings in Massachusetts and serves about 100,000 members, most of whom are connected to the military.

According to the U.S. Small Business Administration, veterans own nearly 2 million U.S. small businesses, employing more than 5 million people. But they’re less likely to receive the funding they’ve applied for compared with non-veteran applicants, according to the Federal Reserve.

It’s a missed opportunity for lenders, Rice said. As home loans have declined, Hanscom FCU doubled down on commercial lending – a relatively untapped front for credit unions – adding a U.S. SBA loan program specifically for veterans. It offers more favorable terms and special carve-outs for veterans.

“It's not about charity. It’s about investing,” Rice said.

Funding options

Traditional financing isn’t the only way forward for veterans in business. More veteran entrepreneurs are turning to crowdfunding platforms like Kiva or Kickstarter, which rely on cash donations from supporters online, said Lisa Ducharme, executive director of the Massachusetts Veterans Chamber of Commerce, which was founded this year.

As new funding options grow, Ducharme said her organization is focused on connecting veteran entrepreneurs with resources for starting and growing their businesses.

“My goal is to start getting veterans thinking about their businesses,” said Ducharme, a retired U.S. Air Force veteran and 3D animation and interactive media entrepreneur.

Pitch competitions are another avenue, and one Hanscom FCU started offering through the Massachusetts Fallen Heroes Innovets Pitch Competition. In May, three startups received cash to help meet their startup costs. Among them was Groton native Michael Kerwin, who patented YouV Sunscreen, which uses UV LED lighting built into the bottle to ensure sunscreen is evenly applied.

Kerwin, a 29-year-old West Point graduate and former Army infantry officer, said the money is a big boost for his initial manufacturing and marketing plans in the daunting world of startups. Kerwin said he’d like to eventually apply for a business loan to help fund inventory, but getting there is a challenge.

“Strategically planning the business, it's very difficult to know what I should be doing now to get to that point,” Kerwin said.

Part of the challenge lies in the divide between workplace cultures of the military and the private sector, Kerwin said. Though he has a mechanical engineering degree from a top military school and works as a manager for the utility Eversource, Kerwin had to get used to different terminology working in the private sector, and he imagines other veterans and former military personnel experience the same learning curve while trying to figure out how to get a business off the ground.

Business development key

This can also be a challenge when applying for a loan, said Michael Duffany, chief lending officer at Hanscom FCU. Duffany is helping lead commercial lending expansion after his hiring in January. The credit union added business development staff to help veterans sharpen their business plans ahead of their loan applications. The son of a veteran entrepreneur, Duffany said many veterans have excellent skills in their fields; they just need a boost in business acumen.

“There’s no better time than the present, if you have a decent idea to open a business,” Duffany said.

For Carla James, a background in the U.S. Air Force actually gave her a leg up when she was just starting out as a self-employed software engineer back in the early 2000s. Now the CEO of Lincoln-based Solidus Technical Solutions, a software firm founded by another female veteran, James said military experience was a credibility boost right out of the gate. She was comfortable working in a male-dominated field, and she estimates the software engineering industry is roughly 80% male.

James said a common scenario for professional services entrepreneurs is to work for a client on site as a billable contractor. She remembers spending evenings trying to figure out how to actually launch her business in the Washington D.C. area, and even put her house up as collateral.

“It can be very scary for people, but I’m not a risk-averse person,” James said.

“You have to adapt”

For James, part of the secret to early success was to hire a good lawyer and accountant, and to secure a business line of credit. She highlighted the many resources available to veterans through the federal government. While registration with the federal Veterans Administration is required, James said it’s worth the effort for the benefits of set-aside programs for federal contracts. Additionally, the U.S. Small Business Administration Office of Veterans Business Development offers numerous programs to this end.

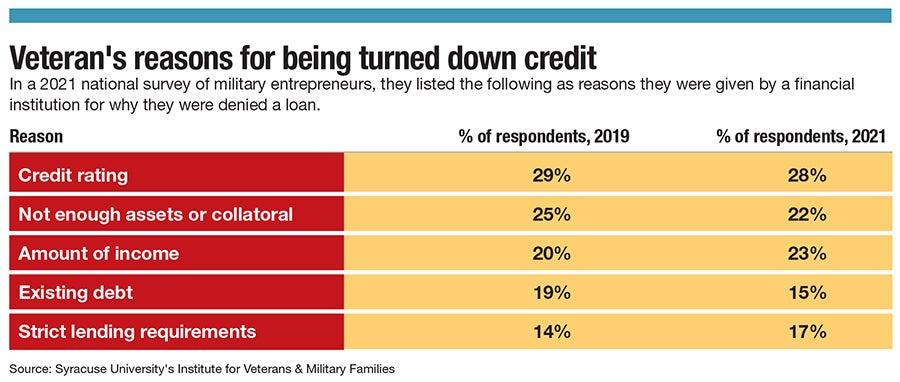

Such programs help veterans who face certain obstacles, whether not having a lot of home equity to borrow against after moving many times during military service, or perhaps having a tax bill fall through the cracks through so many moves, said Ducharme, of the Massachusetts Veterans Chamber of Commerce.

Still, Ducharme believes veterans are well prepared for most any problem.

“Everybody should get stressed over funding, but one of the things we learn in the military is that you have to adapt,” Ducharme said.